As lockdown restrictions ease across the UK and people begin to return to the high street, there has been a surge in demand for goods as people rush to spend the cash they have saved. However, a side effect of this is that inflation has risen more sharply than in prior months.

As lockdown restrictions ease across the UK and people begin to return to the high street, there has been a surge in demand for goods as people rush to spend the cash they have saved. However, a side effect of this is that inflation has risen more sharply than in prior months.

According to figures published by the BBC, UK inflation jumped to 2.1% in May, three times the rate in March, which stood at only 0.7%. This has raised the question of whether inflation is going to continue to grow in the coming months.

Over time, inflation can have a significant effect on your savings, and this could impact your retirement plans. Read on to find out how it might affect you, and two ways that you can counter it.

Inflation erodes the buying power of your cash savings

When you first look at inflation figures, you may not be especially worried. The inflation rate has increased to 2.1%, which may not seem significant by itself but don’t be fooled; it can have a serious effect when you consider the long term.

One of the biggest reasons why inflation affects retired people now more than ever is because people now live for much longer.

If you had retired 30 years ago, your pension would only have needed to support you for around 10 years on average. Now, with higher life expectancy due to better standards of living and healthcare, it may need to last 20, 30, or even 40 years.

Over time, inflation can significantly erode the buying power of your savings. A good way to see this is with the Bank of England’s inflation calculator, which allows you to see its impact on your money’s buying power.

For example, if you had £10,000 in 1990 then you would be able to buy goods and services worth that amount. However, in 2020 you would need £23,244 to buy the same goods due to an average annual rate of inflation of 2.9% in that period.

Low interest rates mean that the buying power of cash savings is being eroded

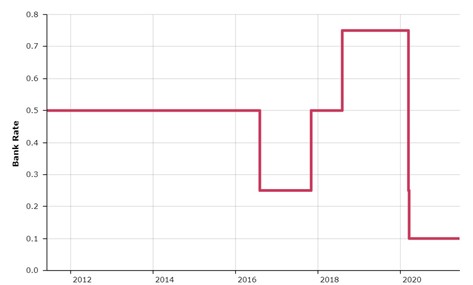

One major problem that many savers have faced in recent months is that while inflation has been below the Bank of England’s target of 2%, interest rates for cash have been lower. The Bank of England base rate, which affects the interest rates that other banks offer, currently stands at 0.1%, as you can see from the graph below.

Source: Bank of England

While this move was aimed at stimulating the economy as a response to the negative impact of the coronavirus pandemic, it has had a significant impact on savers. Since interest rates are typically lower than the rate of inflation, the growth on savings held in cash does not keep pace with the rate of inflation.

This means that the buying power of people’s wealth is slowly being eroded and this poses a significant problem for retired people.

Thankfully, there is one part of your income in retirement that is guaranteed to rise in line with the rate of inflation – your State Pension. This is because of the “triple lock” system, which increases the pension each year based on the highest of:

- The rate of inflation

- Average earnings growth

- 5%

While you may have significant private pensions, this can still form the bedrock of your finances in retirement.

Even though this portion of your income is safe from the effects of inflation, you may want to take steps to protect the rest of your wealth. This is important to ensure that your lifestyle in retirement is comfortable and sustainable.

Investing can enable your wealth to grow faster than inflation but comes with risk

There are two main ways that you can “inflation-proof” your wealth in retirement. The first is to keep it invested, which allows you to mitigate the risk of inflation through seeking strong returns.

Investing in equities typically provides inflation-beating returns that outperform cash and other assets. However, keeping your wealth invested does come with risk, as market volatility could significantly lower the value of your portfolio.

Another alternative is to exchange a part, or all, of your pension pot in exchange for a guaranteed income through an annuity. Index-linked annuities will increase in line with the rate of inflation, so you can rest easy knowing that your buying power isn’t being eroded.

You can also choose other benefits, such as the income continuing to be paid to your partner after you pass away.

If you’re considering an annuity, you may benefit from speaking to a professional first so that you can make a properly informed decision. Furthermore, they can’t typically be changed or cancelled once you’ve bought one, so it’s important to make sure that it’s the right decision for you.

Get in touch

If you want to ensure that your retirement prospects aren’t impacted by inflation, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.