The UK economy has struggled in recent months, caught between the economic strain of the coronavirus pandemic and the uncertainty of Brexit. According to a report by the Office for National Statistics, published by the BBC, the UK GDP is now around 8.5% lower than its pre-pandemic level.

The UK economy has struggled in recent months, caught between the economic strain of the coronavirus pandemic and the uncertainty of Brexit. According to a report by the Office for National Statistics, published by the BBC, the UK GDP is now around 8.5% lower than its pre-pandemic level.

Despite this, some experts predict that the signing of the Brexit deal could help to reverse some of this damage. If you’re wondering how the UK can recover from such a difficult year, read on to find out how the Brexit deal could boost consumer spending in 2021.

The pandemic seriously affected many UK businesses

In 2020, the UK economy struggled due to the twin effects of Brexit uncertainty and the coronavirus pandemic.

When the government implemented the initial lockdown in Spring 2020 to slow the spread of the virus, one of its side-effects was that it caused a significant fall in economic activity. According to figures from the Office for National Statistics (ONS), the UK GDP fell by around 25% in April.

The economic disruption also resulted in a rise in unemployment, despite the government’s attempts to protect workers and businesses with the furlough scheme.

This uncertainty made many households tighten their belts and reduce their spending. According to figures from insurance provider Aviva, the average household cut their spending by 29% during lockdown.

Whilst this helped families save significant amounts of money, it had a detrimental effect on many businesses. Despite there being an increase in online spending during the lockdown, it was not enough to make up for the reduced footfall on the high street.

According to the Barclays Consumer Spending Report for December 2020, despite a growth in online retail spending of 52%, the effects of the lockdown meant that non-essential spending still fell by 4.9% on the whole.

Brexit uncertainty meant many businesses couldn’t prepare for the future

The uncertainty in 2020 surrounding whether the UK would be able to negotiate a trade agreement with the EU before its departure on 31 December was also a cause of economic disruption.

In the event of a ‘no-deal’ Brexit, many companies which exported to Europe faced the prospect of trading difficulties and potentially having to pay tariffs when buying and selling goods.

According to a report published in the Guardian, the price of as many as 13,000 goods would have been affected by tariffs in the event of a ‘no-deal’ scenario. For many businesses, the prospect of tariffs eating into their profit margins, already slimmed by the economic effects of the pandemic, could have been disastrous.

This prospect was particularly troubling for car manufacturers, as a ‘no-deal’ scenario would mean a double shock. Car parts which need to be imported would face new checks and controls at UK ports whilst a potential 10% tariff on the finished product would make exports uncompetitive.

The uncertainty surrounding whether or not the government would be able to negotiate a trade deal with the European Union also made it difficult to plan for the future. Confusion over the possibility of import duties, licences, and other paperwork made it difficult for many companies to plan accordingly, leading to further economic issues.

A report in the Times showed that some European businesses exporting to the UK have been forced to pause trading since confusion over paperwork meant that only around 10% of goods had come with accurate customs forms.

Buoyed confidence from the deal could lead to a rise in consumer spending

Given such a difficult year, it is easy to understand why many Brits limited their household spending in 2020. However, it is likely that this may change in the new year as consumer confidence increases, and the Brexit deal will play a large part in that.

Fortunately for UK consumers and businesses, the UK government successfully managed to negotiate a trade deal in late December, only days before the deadline. Some experts predict that this will precipitate a rise in consumer spending, as confidence increases.

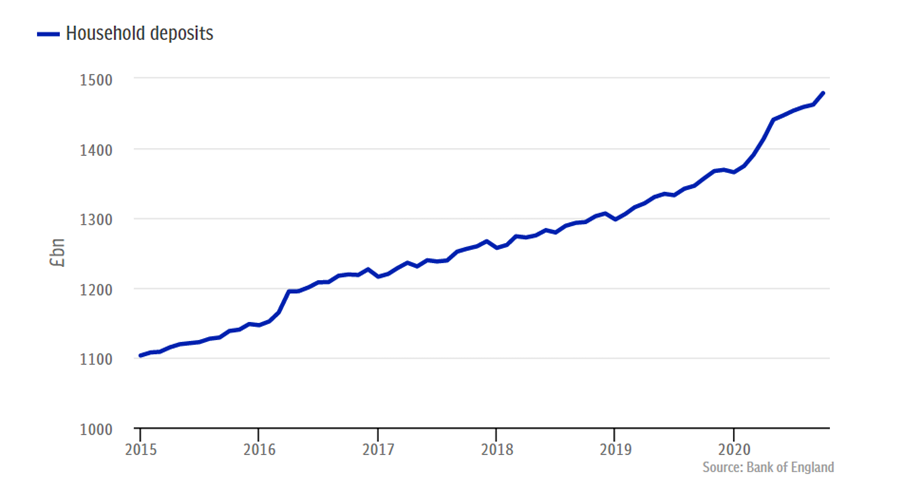

According to a report by the Bank of England, reported in the Telegraph, household deposits by Brits increased by £113 billion between January and October of 2020. In the same period, they also managed to reduce the value of their consumer debts by more than £20 billion.

Source: Telegraph

This puts many Brits in a strong position to spend as economic confidence begins to return. This large boost in consumer spending could help UK businesses recover from the previous year.

Another potential cause for increased confidence is the rollout of the coronavirus vaccine across the UK, which will allow many shops to reopen in due course. Experts hope that when they do, the buoyed consumer confidence will lead to a marked increase in consumer spending.

Get in touch

2021 is likely to bring large changes to the economy so if you’d like to reassess your finances, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.