Retirement is typically seen as a time to take it easy and enjoy the results of your lifetime of hard work. That’s why it’s important to ensure that you have a pension that is large enough to sustain your desired lifestyle.

Retirement is typically seen as a time to take it easy and enjoy the results of your lifetime of hard work. That’s why it’s important to ensure that you have a pension that is large enough to sustain your desired lifestyle.

While it’s easy to fantasise about what you want from your retirement, it’s a much more difficult issue to work out how much retirement could cost. According to a survey by Unbiased, around one-third of Brits don’t know how large their pension pot will need to be.

If you’re approaching retirement and you’re not sure how much you’ll need to pay into your pension, read on for the five factors that can help you to work it out.

1. How early you started saving

One of the biggest factors that will determine how much you need to save into your pension each month is when you first started saving. The earlier you start saving for retirement, the less you will need to save each month, as you will have a longer timescale and can benefit from the effects of compound interest.

According to data from market research group Which?, to afford a comfortable retirement income of £25,000 per year, a couple with no prior savings would need to contribute:

- £213 per month, if they are aged 20

- £276 per month, if they are aged 30

- £384 per month, if they are aged 40

- £647 per month, if they are aged 50

As you can see, the necessary monthly contribution increases significantly the longer you wait to pay into your pension.

The benefit of starting early is that the amount you save is likely to be a smaller percentage of your income.

2. How much risk you are prepared to take with your pension

Another factor that will affect the amount you need to save for retirement is how willing you are to take risks with your investments, such as your pensions.

Typically, savers who take more risks tend to see greater returns on their investments. While this isn’t always the case, as obviously higher risk investing also comes with the potential to lose money, it can have benefits.

If you have a higher risk tolerance, such as if you are several decades away from retiring, you may benefit from greater returns, meaning that your contributions may not need to be as large.

3. When you want to retire

As you can guess, the age at which you retire will have a considerable impact on how much you need to contribute for your pension. The earlier you plan to retire, the longer your pension will need to sustain you for so you may need to increase your contributions to reflect that.

When the government implemented Pension Freedoms in 2015, they gave Brits a greater amount of choice as to how they retire. You can now retire from the age of 55, although this is set to rise to 57 from 2028.

While you won’t be able to access your State Pension, which will probably form the bedrock of your income in retirement, until you reach the qualifying age of 66 (67 from 2028), you can still make withdrawals from private pensions.

If you want to retire at a younger age, you should increase your contributions to ensure that your private pension is enough to sustain you throughout retirement.

4. How you plan to spend your retirement

The activities you plan to do in retirement will also impact how much you need to contribute. For example, if you plan to take long foreign holidays, you’ll need more money to cover those costs.

According to research by Which?, the average retired couple spend around £25,000 per year. However, this amount rises to around £40,000 per year if they wanted to include luxuries such as regular long-haul holidays and a new car every five years.

It’s important to consider what you want out of your retirement so that you can plan ahead accordingly.

5. What other sources of income you may receive

Since your pension may not be your sole source of income in retirement, how many other assets you hold can also play a role in how much you need to contribute to your pension.

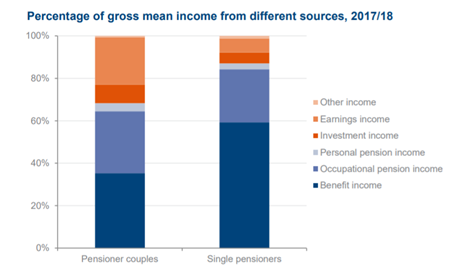

According to research from the Department for Work & Pensions, around a third of the average pensioner couple’s income came from earnings and investments.

Source: Department for Work & Pensions

As you can see, while private pensions and benefit income (which includes the State Pension) makes up a significant portion of many retirees’ incomes, a significant portion comes from other sources.

If you can expect your assets to generate a large income in retirement, you may be less reliant on your pension and so may not need to contribute as much to it.

Get in touch

If you want to save for retirement in the most effective way possible, we can help. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note:

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.