It’s fair to say that chess is a complex game, so much so that players have been using intricate strategies and tactical thinking for years in an attempt to master the ancient pastime.

Aside from strategy, 64 squares, and 32 pieces, there are several intriguing parallels between chess and planning your finances.

Conveniently, the World Chess Championships are occurring between 3 and 25 April, so now may be the ideal time to review some of these similarities. Continue reading to discover five ways you could apply the wisdom woven into the game of chess to your own financial situation.

1. Don’t be afraid of risk

Chess isn’t always as straightforward as it seems, as many players will often boldly sacrifice one of their pieces to secure a more advantageous position.

For example, the “Smith-Morra Gambit”, a common response to the famous “Sicilian Defence”, involves sacrificing one of your pawns to quickly develop your side of the board and open up some attacking opportunities later in the game.

While this strategy may seem dangerous, sometimes you must take risks to gain opportunities later on, eventually being the difference between winning and losing.

Similarly, when it comes to your wealth, there are risks associated with almost all forms of investing and financial decision-making. Regardless, if you avoid risk wherever you can, this could ultimately end up costing you.

This is because, as a general rule of thumb, the more risk you take on, the higher your potential returns are. Of course, extra risk also means your chances of incurring losses also rise.

Equally, it’s also important to take on an amount of risk that suits you. For instance, using the Smith-Morra Gambit mentioned above, if you didn’t know how to employ the strategy, you would likely be in a disadvantageous position when your pawn gets taken.

To ensure you’re correctly managing risk and taking on an adequate level, it may be worth creating a “risk profile”. To do so, it can be prudent to assess your:

- Overall investment time frame

- Goals for the future

- Specific financial circumstances

- Attitude towards risk.

This could give you a clear picture of how much risk you can realistically take on in your position, and you can then ensure that your portfolio aligns with your profile.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

2. Patience is a virtue

Patience is perhaps one of the key elements in chess, especially considering that some games can take hours.

In fact, the longest chess game ever recorded was played between Ivan Nikolic and Goran Arsovic. It lasted for over 20 hours and took 269 moves to complete.

Much like you should be prepared to wait for potential success when you play chess, it’s also important to take a long-term view of your finances.

This is especially the case when you invest, as doing so could help your wealth ride out periods of volatility and potentially recover eventually.

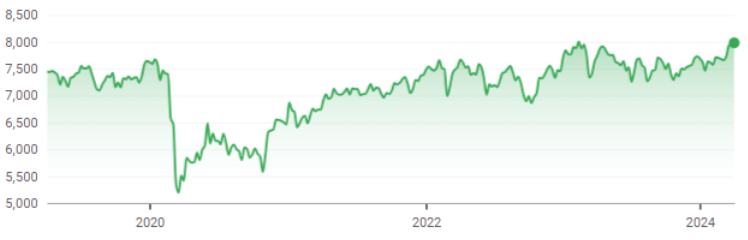

Take this five-year graph of the FTSE 100 stock market index, for example:

Source: Google Finance

As you can see, the value of the index fell considerably when the Covid-19 pandemic caused global lockdowns at the start of 2020.

If you maintained a short-term focus on your investments, this sharp fall in value may have prompted you to sell your investments and cut your losses.

However, by doing so, you would have missed out on the FTSE 100’s subsequent recovery by early 2023, rising above its pre-Covid levels.

Instead of seeking a quick win (or trying to avoid a loss), staying invested for the long haul can often benefit your wealth.

Past performance is not a reliable indicator of future performance.

3. Learn to adapt to any situation

When you play chess, you need an immense amount of forward-thinking to stay ahead of your opponent.

That said, while you could meticulously plan out every move and your responses to your opponent’s moves, this can, in reality, be more challenging than you think.

In fact, National Museums Liverpool estimates that there are between 10 to the power of 111 and 10 to the power of 123 total positions in chess. There are more possible variations than there are atoms in the observable universe!

No matter how much you plan ahead, the game’s dynamic can often shift in a direction you hadn’t previously anticipated. As such, it’s vital to adapt to sudden changes to give yourself the greatest chance of victory, and the same thing can be said about your finances.

Indeed, the financial landscape is constantly changing. For instance, the chancellor can alter tax rules and savings thresholds in the Budget, meaning you need to remain agile and adaptable to stay on top of any changes.

It can be helpful to continuously learn about market trends, economic developments, and geopolitical events. This can give you keen insight into making informed decisions about your wealth, ensuring that you remain adaptable in the face of uncertainty.

4. Have a plan for the end game

The end game in chess is perhaps one of the most critical phases of a match. Even if a player has been winning for the entire bout, they could still lose right at the end.

Since you likely have fewer pieces on the board at this stage of the game, you typically need to calculate your moves more. If you make even the slightest misstep when the end is in sight, it could end up costing you the entire game.

When it comes to your finances, it’s often prudent to have a concise plan in mind for the “end game”.

For instance, it’s important to consider your long-term goals and milestones that you’re saving for in the first place, such as the deposit for a home, retiring comfortably, or financing your children’s education.

Keeping these goals in mind and planning out how you’ll achieve them could keep you motivated to reach your targets.

5. Practise with a “second”

It’s prevalent for top chess players to practise with “seconds”, usually other professional players who assist them with preparation for tournaments.

These seconds tend to be very strong theoreticians or specialists in particular move sets, which helps the top players identify any weaknesses in their strategy.

Similarly, it can be incredibly beneficial to employ the help of a financial planner to act as your “second” when it comes to your wealth.

They can offer long-term observations of market trends and detailed breakdowns of forecasts to ensure that you remain on the right path.

As well as giving bespoke advice about creating a balanced portfolio, a professional could assist you with your wider financial plan.

For example, they could help you manage your tax liability, ensure that you have a watertight will in place, and even make sure you and your loved ones are adequately protected in case you were to become ill or die unexpectedly.

The Financial Conduct Authority does not regulate Wills and tax planning.

To find out how we could act as your “second”, please email us at info@investmentsense.co.uk or call 0115 933 8433.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.