According to the Office for National Statistics, the UK inflation rate in the 12 months up to December 2021 was 5.4%, the highest it’s been for three decades. There’s also the possibility of further rises throughout 2022, with increasing energy and fuel costs as key contributors.

A higher cost of living could put millions of Brits in a tough financial situation this year. As such, here are five ways to help protect your wealth as prices rise.

1. Beat the National Insurance rise

National Insurance contributions (NICs) will rise for most employees, employers, and the self-employed by 1.25p in the pound from April 2022. The BBC report that an employee earning £30,000 a year will pay £214 more each year, while those earning £80,000 will pay an additional £839 a year.

If you earn more than £9,880 a year, the amount of NICs you pay will increase. As such, consider making use of a salary sacrifice scheme to reduce the amount of NICs payable by both you and your employer.

A salary sacrifice scheme converts a portion of your salary into non-cash benefits, such as a cycle to work scheme or additional pension contributions. The amount that is taken out of your salary is not considered when calculating the amount of National Insurance that you need to pay.

However, salary sacrifice also effectively reduces your salary. So, if you apply for a mortgage, for example, you might be able to borrow less. It may also have an impact on other benefits, such as a “death in service” payout (as this will typically be based on a multiple of your salary).

Before agreeing to salary sacrifice, contact a professional. We can help you fully understand both the benefits and downsides of this approach in reference to your personal circumstances.

2. Review your spending

One of the best ways to protect your finances against a rising cost of living is to analyse what you actually spend your money on. Consider going through your bank statements and cancelling direct debits for items and services you no longer use.

Check how much you pay for your gas and electricity and work out if there are ways of lowering them, such as turning off things you typically leave on standby or putting your heating on a timer.

It could be especially crucial to analyse now as the BBC believe the energy price cap rise in April could see bills rising by as much as 50%.

Also, think twice before making large purchases. Ask yourself whether you need to replace your old TV or laptop, and whether taking them to a local repair shop would be cheaper. Any savings you make here can be put away to help you if you find yourself struggling with the rising cost of living.

3. Work out your personal inflation rate

The official inflation rate is calculated using a “basket of goods”, a collection of thousands of everyday items which have all increased or, in some cases, decreased in price at different rates. What this means is that your personal inflation rate may not be the same as the official figure, depending on what you buy.

The rising cost of petrol is one of the main contributing factors to a high inflation rate, meaning that if you don’t drive and spend less on petrol, your personal inflation rate could be low in comparison. As such, calculating your personal inflation rate could help you formulate a spending plan.

4. Change your mortgage (and other bills)

Letting your mortgage automatically move onto your lender’s standard variable rate (SVR) at the end of your fixed- or tracker-rate period could see your repayments rise sharply. This is because the SVR offered by most lenders is usually higher than any other deals they may offer.

If your mortgage deal is coming to an end, it can pay to look for opportunities to remortgage, especially in an environment where interest rates are rising. It could give you the opportunity to secure a low-rate deal now and to minimise your monthly outgoings.

If you have an existing fixed-, variable- or tracker-rate mortgage deal, it may be worth waiting until the end of the initial period before switching. This is because exiting a deal could come with early repayment charges which may outweigh any potential savings.

You could also look to reduce the cost of your other bills by switching supplier. One of the best ways to do this is by using a comparison site, which will list all the available deals various suppliers offer.

5. Consider investing if you aren’t already

Some savings rates have increased alongside the recent rises in the base rate, but the effect it has on your wealth can be limited. As such, your wealth may be losing value in real terms.

If your savings are only earning 0.1% interest, but the cost of living is rising by more than 5% each year, then the extra you spend is likely to vastly outweigh what you earn in interest.

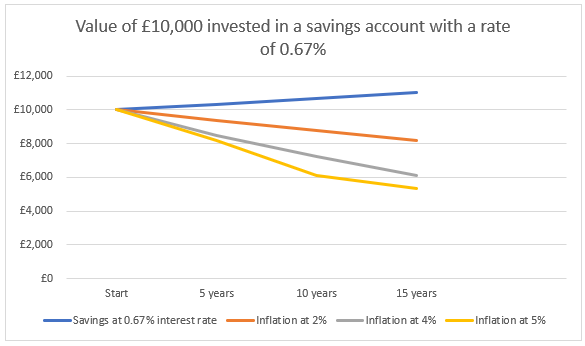

The chart below demonstrates what happens to the purchasing power of £10,000 when the inflation rate is at 2%, 4%, and 5% over 15 years.

Please note: Savings account interest rate taken from Times Money Mentor article with highest interest rate of 0.67% from Shawbrook Bank. This assumes no tax is paid on the interest. Chart This assumes that inflation remains at 2%, 4% or 5% for the whole period.

Source: Royal London

To give your savings a chance of keeping up with inflation, you could consider investing some of your wealth. Historically, returns from investing have outperformed the interest received on savings accounts, with this especially true in recent years.

Though past performance is not necessarily indicative of the future, Barclays have shown what would have happened to £10,000 if it was saved and invested in January 2001 and left until December 2021.

In cash, a saver would have earned about £7,757 in interest, bringing the total to £17,757. If the money had been invested in the FTSE 100 it would be worth a total of £23,286, and if it were invested on the FTSE All-Share it would have reached a total of £27,417.

The largest returns would have been achieved by investing in developed market shares across the world, represented by the MSCI World Index, and would have been worth £40,515.

Note that all returns are gross of fees.

Though this level of growth is impressive, remember that returns are not guaranteed. Your capital is at risk and your investments have the potential to go down in price as well as up.

It is worth remembering that higher returns often come with higher risk, and investing internationally is no different. International stock markets can be volatile, and you should always remember that investment returns are not guaranteed, and you may not get back the full amount you invested.

If you would like to receive advice on how to approach investing safely, or other ways of beating inflation, please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

This article is for information only. Please do not act based on anything you might read in this article.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.