In recent years, there has been a large increase in the number of people getting involved in investing. A significant portion of these new investors are millennials, although there has been a sizeable number of new older investors too.

In recent years, there has been a large increase in the number of people getting involved in investing. A significant portion of these new investors are millennials, although there has been a sizeable number of new older investors too.

If you’re one of them, or if you’re considering investing in the near future, here are seven investment tips to bear in mind to help you manage risk and grow your wealth.

1. Have a plan, and stick to it

The first step is to decide how much you’re going to invest and in what way. This could either be a lump sum or regular monthly amounts. The key is to make sure you can afford it, and that you won’t be leaving yourself short when it comes to essential spending.

If you have a clear goal in mind, it makes it easier to work out how long you need to invest for and how much you should be starting out with.

For example, investing in the stock market over a long period can deliver healthy average annual investment returns. However, stock markets can also be volatile, so probably aren’t the best option if you’re looking for a short-term investment.

If you know you’re investing for something tangible, such as a deposit for a mortgage, you’re more likely to be able to discipline yourself to make the regular monthly commitment, rather than being tempted to divert the money elsewhere.

Although there is no minimum term for investments, to minimise risk you may want to aim to invest for a period of at least five years.

2. Understand the relationship between risk and return

One of the most important facts about investing is that different types of investment carry different levels of risk. For example, investing directly into company shares will typically carry more risk than investing in government bonds.

Investments with a higher level of risk will potentially provide a greater return but, at the same time, there’s a higher chance of you losing money.

3. Diversify your investments

To put it simply, don’t put all your eggs in one basket!

Once you’ve made the decision to invest, you may find there are many different options of how and where to invest your money. These are usually referred to as “markets” or “sectors” and it’s important to spread your investments across several of them.

By diversifying your assets, you reduce the risk of losing money in the event of a particular market experiencing a crash. Instead, only part of your fund will be impacted, and there’s a good chance that losses in one sector could be offset by gains in another.

You don’t need to have a series of different investment plans to invest in this way. Many Individual Savings Account (ISA) providers, for example, will enable you to hold different investments within a single ISA “wrapper”.

4. Be aware of the impact of charges

It’s also important to be aware that different investment funds often carry different charges.

Over time, these charges can have a big impact on the value of your investments. On investment funds the charge is expressed as a percentage of the total value of the fund – including any investment growth.

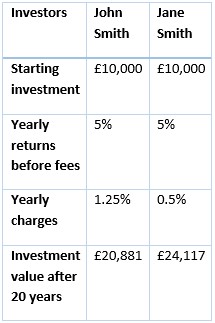

For example, you can see the impact of charges on an investor’s wealth in the table below. This shows the returns on a one-off £10,000 investment with varying annual charges but no upfront charge:

Source: Candid money investment calculator

As you can see, while the difference in charges is only small, over the long term they can make a considerable impact on your investments.

5. Invest for as long as possible

As the old investment adage says, “it’s time in the market, not timing the market”.

Having a clear understanding of your investment goals will give you a good idea of how much you need to invest, how long you should be investing for, and what level of risk you will be comfortable with.

Most investment professionals will typically recommend that you look to invest for as long as possible to reduce the impact of short-term market volatility as these can have a significant impact on your investments.

If you want to avoid the effect of short-term disruptions, you should consider investing for at least five years.

6. Make the most of dividends

If you invest in shares in a specific company, you can also benefit from dividends. These are the bonuses paid to shareholders, usually annually, from company profits or reserves.

Dividends can be taken as income or reinvested through the purchase of new shares. If you choose to reinvest them, you could benefit from compound growth as you may receive even more dividends in the next year.

It’s important to note that the dividend is calculated based on the number of shares you hold, rather than the overall value of your holding. This means that, even if a share has reduced in value, you will still benefit from a dividend return.

7. Maximise your ISA allowance

There are a variety of different investment vehicles where you can invest your money. These include pensions, stocks and shares, government bonds, and investment funds.

A good option to begin with, if you’re just starting to invest money is an ISA. Stocks and Shares ISAs can offer a wide range of investment options, including individual shares and investment funds.

One of the main benefits of investing in this way is that any growth is not subject to Capital Gains Tax or Income Tax, making them a tax-efficient way to save.

Each year you have an allowance for how much you’re allowed to contribute to your ISA and in the 2021/22 tax year, this stands at £20,000.

Get in touch

If you want to be able to make informed decisions when investing your wealth, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.