If you’re a keen saver, you’re sure to know how important it is to keep an eye on the rate of inflation, as it can erode the value of your savings in real terms.

If you’re a keen saver, you’re sure to know how important it is to keep an eye on the rate of inflation, as it can erode the value of your savings in real terms.

The Treasury have recently confirmed that they will be aligning the Retail Prices Index (RPI), a measure of inflation, with the consumer price index including housing costs (CPIH) rate by 2030. Although this move may have benefits for the Treasury, it may also have a significant impact on many pensioners.

If you want to know what this change means, and how it may affect your retirement plans, read on to find out how the change from RPI to CPIH could impact your pension.

One criticism of RPI is that it overestimates the cost of living

The government measures inflation with several metrics, but two of the most common are RPI and CPIH.

Both methods measure the rate of inflation by tracking the change in prices of a basket of 700 goods and services. However, the two rates differ in how the government measures them.

When assessing the value of the basket of goods and services, the CPIH takes into account the households of high-earners and pensioners. Since the RPI does not, critics argue that it isn’t fully representative of all UK households, and so overestimates the cost of living.

This change may not seem especially significant on the face of it, but what makes it controversial is the fact that it will likely have a negative impact on many people’s pension funds.

To prevent their real value from being eroded over time, many pensions increase by a small amount each year and this rise is typically linked to the rate of inflation.

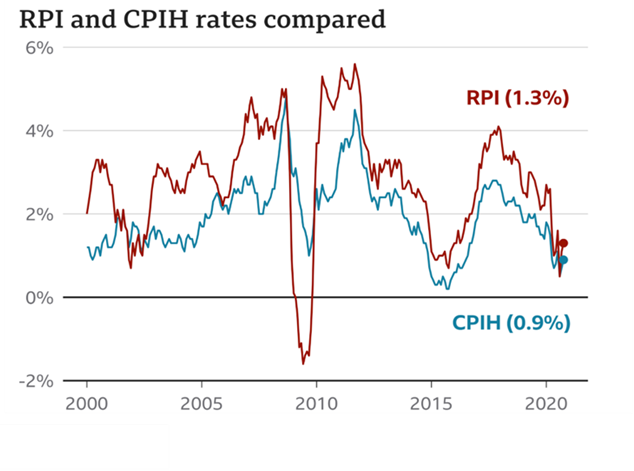

As you can see from the graph, CPIH is usually lower than RPI by around 1%, meaning that pensioners are likely to see a smaller annual increase in their benefits after the change.

Source: BBC

Holders of defined benefit pensions will be significantly impacted by the change

While many public sector pensions are already linked to CPIH instead of RPI, when the government implements this change it will affect millions of people who hold private sector pensions.

People who hold defined benefit pension schemes will be particularly affected, as the income that they provide typically rises in line with the RPI. After the government has made the change, they will see their pensions grow more slowly each year.

The move to CPIH will have a significant impact, as experts estimate that around 1.3 million people are currently contributing to a defined benefit pension scheme. On top of this, a further 11.8 million may be able to claim one in the future.

This change may mean that many of those people must reassess their retirement plans, as the reduced growth on their pension funds may have an impact on the kind of lifestyle they can afford in retirement.

According to a report by the Pensions and Lifetime Savings Association, holders of defined benefit pension schemes could be worse off by as much as 9% over the course of their lifetime.

Furthermore, if you receive an income through an annuity which is set to rise in line with inflation, this will also be affected and will grow more slowly.

While the difference between the measurements of inflation may seem relatively small, with the CPIH generally only being around 1% lower, this can have a significant effect in the long term.

According to a report published by the Association of British Insurers (ABI), published in FT Adviser, the change to CPIH could wipe out as much as £96 billion in pension growth. Some experts have warned that such a significant shortfall may even require government intervention.

Index-linked gilts will see smaller returns after the switch to CPIH

While the government has not used RPI as an official national statistic since 2013, they still use it when calculating the returns on government-issued bonds, known as “index-linked gilts”.

This means that holders of these gilts are set to lose out from the change, as they would grow at a much slower rate than predicted when they were bought.

According to the report by the Pensions and Lifetimes Savings Association, the move to CPIH could reduce the value of these investments by as much as £60 billion.

Since gilts are typically seen as a low-risk investment, they often make up a significant portion of portfolios for people approaching retirement. This means that not only will defined benefit pension schemes be affected, but a large portion of many people’s portfolios may be too.

Thomas Selby, from the investment firm AJ Bell, was quoted in the Guardian as saying that, all in all, the switch to CPIH could “lead to a retirement worth thousands of pounds less”.

If your pension will be impacted by the change, you may want to consider speaking to a financial adviser, who can help you to reorganise your finances to ensure that your long-term plans won’t be affected.

Get in touch

If you’re concerned that the change to CPIH will impact your retirement plans, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.