Buy to Let changes were first introduced in the 2015 Summer Budget. More fiscal and regulatory policy changes followed, with the latest set to take effect from April 2020.

Buy to Let changes were first introduced in the 2015 Summer Budget. More fiscal and regulatory policy changes followed, with the latest set to take effect from April 2020.

But are you ready for them? Here’s our guide to the six things you need to know about Buy to Let in 2020.

1. Mortgage interest rate tax relief changes

Tax relief on mortgage interest began to be phased out in 2017.

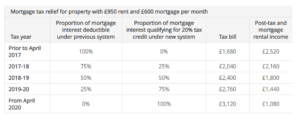

As the table shows, from April 2020, you will no longer receive any mortgage interest rate tax relief. Instead, you’ll get a tax credit based on 20% of your mortgage interest payments.

Source: Which?

If you’re a higher rate taxpayer, you could be especially hit by the change. Under the old rules, you received 40% tax relief compared to only 20% in tax credit under the new system.

This is Money report that ‘One in four landlords now say they are considering selling a property over the next 12 months. That’s equivalent to 500,000 of Britain’s two million property investors.’

2. Stamp Duty surcharge at 3%

A 3% surcharge on Stamp Duty for Buy to Let properties was first proposed in the 2015 autumn statement. It came into effect in April 2016.

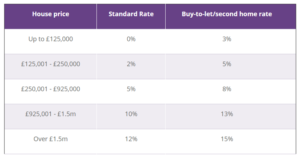

The tiered system is based on the price of the second home or Buy to Let property, as shown in the below table.

Source: moneysupermarket.com

The government has also pledged to introduce a new Stamp Duty surcharge for non-UK residents investing in UK property. The surcharge will be up to an additional 3% on top of the original 3% in force since 2016 and could come into force in 2020.

3. ‘Section 21’ to be repealed?

Back in April 2019, the government announced that it planned to repeal Section 21 of the Housing Act 1988. The so-called ‘no-fault’ eviction enabled landlords to evict shorthold tenants without having to establish fault on the part of the tenant.

The Queen’s Speech at the end of 2019 confirmed the repeal of Section 21 and so it’s now only a matter of time before this law is repealed.

Neil Cobbold, chief operating officer of PayProp, the lettings payment automation provider, is reported in Landlord Today as warning that, “letting agents and landlords need to start preparing for change and updating their processes accordingly as it has been confirmed that the evictions process will [also] be reformed through the same Bill.”

According to FTAdviser, ‘Landlords have raised concerns that the change will make it more difficult for them to evict tenants who fail to pay rent or damage properties’.

4. Private residence relief changes

Changes from April mean that you might pay higher Capital Gains Tax (CGT) if you let a property that was, or has been, your home.

Private Residence Relief (PRR) means that landlords who used to live in the property as their main residence but are now selling it might not pay CGT on profits.

Under current rules, you do not pay tax on the final 18 months that you owned the property but from April 2020, this will shorten to nine months.

Changes are also expected to Letting Relief. This reduces the CGT owed on a property by up to £40,000 of tax-free gains, or £80,000 for couples.

Letting relief applies if you used to live in the property you are selling, and have also let it out for residential accommodation. New rules in force from April 2020 mean you can only claim this relief if you live there when it is being sold, i.e. if you share occupancy with your tenant.

5. CGT needs to be paid quicker from April

From April 2020, the way CGT is paid if you sell a second home or a Buy to Let property is changing. Previously, you would have included it on your tax return, meaning that payment wouldn’t be due until the January after the tax year in which the gain was made.

From April 2020, if you sell a UK residential property and CGT is chargeable, you will have 30 days from the date of completion to pay the tax owed.

This significantly reduces the amount of time you have to pay the tax due if you make a sale in the 2010/21 tax year:

- A sale made on 1 April 2020 – tax payable 31 January 2021

- A sale made on 1 May 2020 – tax payable 31 May 2020

6. Have you considered Buy to Let through a limited company?

The raft of changes introduced since 2015 has seen landlords look to limited companies as a vehicle for managing their rental business. Recent research from Foundation Home Loans, as reported by Moneyfacts, has revealed that ‘almost two-thirds of the landlords surveyed said that they were planning to buy using a limited company… a significant increase since quarter two [of 2019] when the figure stood at 55%’.

Setting up a limited company for Buy to Let means you are not taxed as an individual. You pay Corporation Tax instead and can also pay yourself dividends. It can work out cheaper following the recent tax relief changes but you should also be aware that Buy to Let mortgages for limited companies typically charge higher interest rates than those for individual landlords.

You may also need to pay Stamp Duty if you transfer from an individual (or couples’) name to that of a business.

If you’d like to discuss anything to do with Buy to Let, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

Tax Advice, Buy to Let (pure) and commercial mortgages are not regulated by the Financial Conduct Authority. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.