The year so far has seen the end of a decade-long bull market, the start of a bear market, and a potential bear market rally.

The year so far has seen the end of a decade-long bull market, the start of a bear market, and a potential bear market rally.

But what do these terms actually mean? And how do they impact on your investments and your long-term financial plan?

What are bull and bear markets?

First off, some definitions

- A bull market – The general rule of thumb is to look for movements in investment prices of 20% or more in either direction, held over an extended period. Rising prices signify a bull market.

- A bear market – Signified by falling prices, we are said to be in a bear market when the price of an investment falls by 20% or more over an extended period.

When defining an ‘extended period’, the US Securities and Exchange Commission suggests a rise or fall should be over at least two months.

Broadly, a bull market can be described as rising prices and an optimistic market. A bear market on the other hand, usually means a loss of market confidence.

What about a bear market rally?

As an investor, you’ll be hoping that after a large drop in the markets, a rise follows. The appearance of an upward spike might see your optimism return, along with the hope that the rise signals a return to a bull market. But remember that the trend must be large (20%) and sustained for around two months before it can be called a bull market.

These short-term rises are known as a ‘bear market rally’ and they can last for weeks or months without becoming a true bull market. Although a bull market may emerge, the spikes might signify a so-called ‘bear trap.’

Be wary of short-term upward spikes. Prices could fall again.

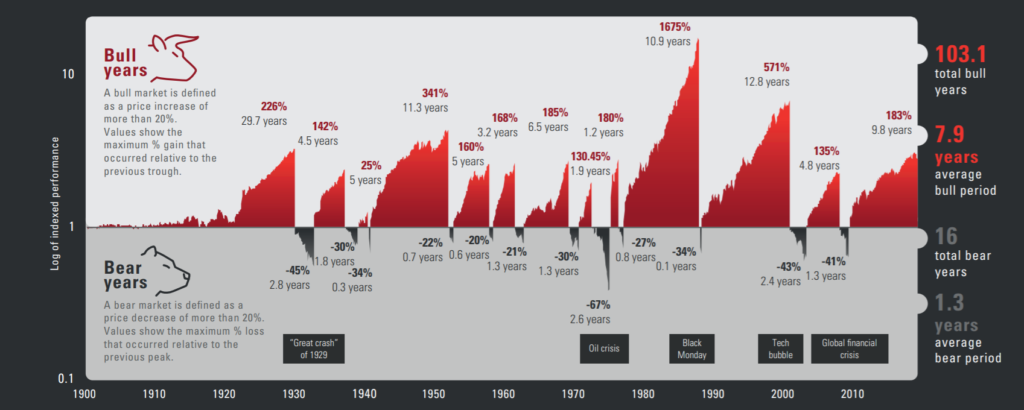

Bull and bear markets since 1900

Both a bull and bear market are characterised by movements of 20% or more, over a two-month period. Although they are effectively the opposite of each other, a look at the FTSE over the last 120 years shows that the two markets don’t behave as a mirror image of each other.

Source: Vanguard

Notes: Calculations are based on FTSE All-Share (GBP Total Return). A bear market is defined as a price decrease of more than 20%. A bull market is defined as a price increase of more than 20%. The plotted areas depict the losses/gains ranging from the minimum, following a 20% loss, to the respective maximum, following a 20% appreciation in the underlying index. Time period: 31 January 1900 to 31 December 2018. Calculations based on monthly data. Logarithmic scale on y-axis. Source: Global Financial Data.

The graph shows bull and bear markets over time. You can see that there have been 103 total bull years since 1900, but only 16 bear years.

Although bull runs are followed by bear markets, bear periods last for a much shorter time. The average bull period lasts for nearly eight years, whereas the average bear length is just 1.3 years.

2020 so far

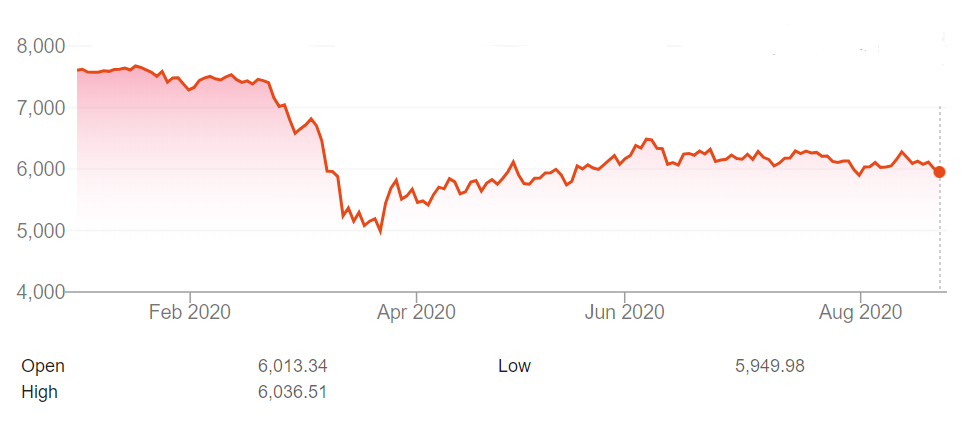

The coronavirus pandemic emerged early in the year and caused uncertainty in the markets. That was reflected in massive drops in March. Prices fell and so too did market confidence.

The BBC reported on 12 March that the FTSE 100, the S&P500 and the Dow Jones had all suffered their worst single-day falls since 1987. This market volatility brought a record-breaking bull run to an end in the US. The bull market had emerged out of the 2008 global financial crisis.

Bear market rallies emerged at the end of March and the FTAdviser warned of potential bear traps.

A few months on, a recovery is underway in the UK. In the US, meanwhile, the New York Times – looking to the performance of the S&P500 – report that ‘a remarkable display of investor optimism… confirms that American investors are in a bull market again.’

What this all means for you

Your investment portfolio is intended for the long term and is diversified exactly to spread the risk of large stock market falls.

Despite the dramatic market drops in March, the history of bull and bear markets is clear.

The general trend is for stock markets to rise and a bull market tends to last longer and to outweigh the losses of a bear market. The important thing is not to panic when markets fall but to ensure you are invested and able to take advantage of rising prices when the market recovers.

Get in touch

If you’d like to discuss any aspect of your investment portfolio, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.