The government introduced the first Child Trust Funds (CTFs) back in 2005. Children born after 1 September 2002 were eligible, meaning that the first recipients of a CTF reached the age of 18 in September 2020.

The government introduced the first Child Trust Funds (CTFs) back in 2005. Children born after 1 September 2002 were eligible, meaning that the first recipients of a CTF reached the age of 18 in September 2020.

According to a recent Guardian report, more than 6 million CTF accounts were opened, estimated to total around £9 billion. The report also suggests that around two million accounts might be ‘lost’ to the children they were opened for.

If you think your child’s account is lost – because you’ve changed address or misplaced the relevant paperwork – keep reading to find out how you can find it again.

And, if your child is due to receive a CTF payout, also read what they might do with the money they receive.

But first, what is a CTF?

CTFs in brief

Launched in 2005, CTFs were the government’s attempt to encourage parents to save on their children’s behalf. CTFs ceased for children born after 2 January 2011 – when the Junior ISA (JISA) replaced CTFs – but CTFs already in place remain valid. The last is due to mature around 2029.

The government incentivised CTF sign up by providing a £250 initial deposit in the form of a voucher. The size of the voucher rose to £500 for low-income families.

Once opened by a parent or legal guardian, family friends, and relatives could pay into the fund, up to a maximum limit originally set at £1,200. The limit now runs in line with that of a JISA – that’s £9,000 for the 2020/21 tax year.

There are three main types of CTF: Cash, Stakeholder, and Shares-based.

With a Cash CTF, you make deposits on your child’s behalf, just like with a savings account, and any interest you earn is tax-free.

A Stakeholder CTF invests in the stock market, with the fund moved gradually to lower-risk investments when your child reaches age 13. Finally, a Shares-based CTF works similarly to a Stakeholder CTF, except the money invested does not have the same protections. You are, though, free to choose where the money is invested.

How much is your child’s CTF worth?

The value of the fund at age 18 will depend on many factors, from the amount paid in, to the investment performance.

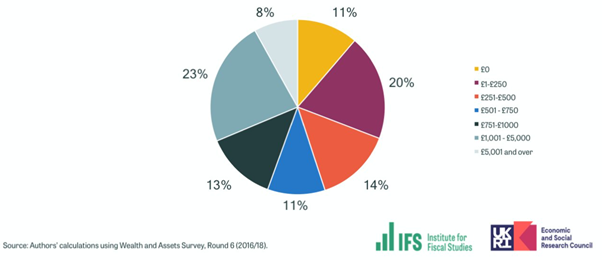

The Institute for Fiscal Studies looked at the value of CTFs taken out by children in the first year of eligibility – those born from September 2002 to August 2003.

Nearly half (45%) of the CTFs taken out during that time will have a fund value of less than £500. However, close to a quarter (23%) will have more than £1,000, and 8% could be in line to receive more than £5,000.

What should your child do with their money?

However much your child is about to receive, it’s important they use the money wisely. Here are three ways it might be used:

- Keep it invested

CTFs not taken at age 18 will usually convert to an adult ISA.

As with CTFs, ISAs are tax-efficient. Interest from a Cash ISA is tax-free and any gains your child makes on investments in a Stocks and Shares ISA are free of both Income Tax and Capital Gains Tax (CGT).

The type of ISA your child’s CTF converts to will depend on the type of CTF held.

There is an annual subscription limit of £20,000 into an ISA so your child could make large savings once they start earning.

- Move it to a Lifetime ISA

If your child is looking to start saving towards a first home, they might use their CTF fund as an opening deposit into a Lifetime ISA (LISA). This is a tax-efficient way to start saving for a house.

Open to those aged between 18 and 39, money deposited into a LISA receives a 25% top-up from the government. The current annual limit for payments into a LISA is £4,000, which means your child could receive £1,000 from the government each year.

The money must be used to buy a first house or left invested until after your child’s 60th birthday. Withdrawals made before age 60 or not used towards a first house will be subject to a 25% charge.

- Help through university

If your child is heading to university, they might want to use the money in the shorter term.

Using the money for living expenses – accommodation, food, books – might be a great way to relieve financial pressure.

It might be tempting to put the money towards tuition fees outright but with interest rates on student loans low, the money might be better off used elsewhere.

Finding a lost CTF

Nearly two million CTFs could be ‘lost’ to the children they were taken out for. If you think a CTF for your child might be lost, you can trace it by filling out this HMRC form.

Fill out the form and, if you have one, HMRC could send you details of your Child Trust Fund provider by post within three weeks.

Get in touch

If you’d like to discuss any aspect of CTFs or saving a nest egg for your child or grandchild, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.