On 18 July AD64, an orange glow was cast over the mighty city of Rome as a great fire consumed entire districts, leaving a trail of devastation in its wake.

On 18 July AD64, an orange glow was cast over the mighty city of Rome as a great fire consumed entire districts, leaving a trail of devastation in its wake.

Legend states that while this was happening, the infamous Emperor Nero was incredibly moved by the sight of the blaze.

Dressed in theatrical garb, he reportedly ascended to the roof of the palace to get a better view, recited a poem concerning the destruction of Troy, and strummed a proto-guitar called the “cithara”.

This heinous act gave rise to the phrase “fiddling while Rome burns”, which has become synonymous with inaction in the face of crisis.

Of course, the saying has negative connotations – there aren’t many situations in life where “fiddling where Rome burns” is the correct course of action, after all.

Yet, when it comes to investing, it might actually be wise to stay calm and collected during a period of downturn or uncertainty. Continue reading to discover why this is the case, and some ways you can keep a cool head when markets are especially volatile.

Remember that acting on your fear often isn’t helpful during periods of downturn

The Great Fire of Rome serves as a stark reminder of how panic can exacerbate a situation. The fire itself was devastating as it tore through the city, which mainly consisted of ramshackle wooden buildings packed into narrow lanes.

The Roman historian, Tacitus, wrote of the situation, “When people looked back, menacing flames sprang up before them or outflanked them. When they escaped to a neighbouring quarter, the fire followed, and even districts believed remote proved to be involved.”

Interestingly, much of the destruction came at the hands of the residents of the Eternal City. After being whipped into a panic, many actively encouraged the fire to spread so looting could continue unrestricted.

While an event of this magnitude isn’t entirely comparable to how people react to market downturns, there is a chance you might start to worry when you witness the value of your investments begin to fall.

In response, you may feel the need to sell your investments to cut your losses. This is somewhat understandable when your hard-earned wealth is on the line.

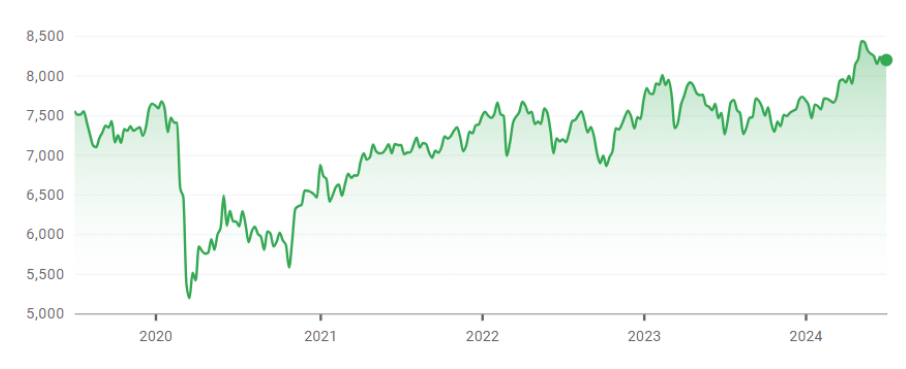

However, doing so could mean you crystalise your losses, locking them in permanently. Consider this graph, which shows the five-year performance of the FTSE 100 stock market index:

Source: Google Finance

As you can see, the value of the index dropped considerably in March 2020 after the Covid-19 pandemic. Though, by February 2023, it had recovered well above its pre-Covid levels.

If you sold your investments in an emotion-led response to the market decline, you would have missed out on this subsequent recovery and set your losses in stone.

So, taking a long-term approach to your investments and remembering that they could eventually recover could prevent you from turning a paper loss into a real one.

Keep in mind that markets tend to bounce back after negative events

The Great Fire of Rome was incredibly destructive, affecting 10 of the city’s 14 districts and leaving two-thirds of the glorious capital in ruins, resulting in thousands of cases of homelessness.

Despite this, the Eternal City rose from the ashes and continued to thrive for hundreds of years as the shining jewel of the Mediterranean. In fact, the destruction even made way for the magnificent Colosseum, which was built shortly after the fire.

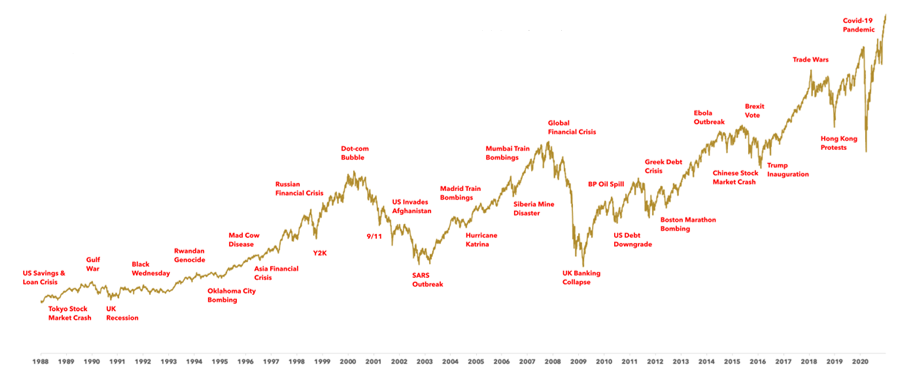

Just as Rome recovered from this period of darkness, it’s worth pointing out that markets also have a history of bouncing back from negative events.

Indeed, this graph shows that, between 1988 and 2020, some seismic events significantly affected market performance:

Source: Humans Under Management, Bloomberg

Over this period, many events have had an immediate effect on the market. Even so, the overall trend has remained upward over time, underscoring the importance of investing with a long-term perspective, ideally for five years or more.

If you do as Nero did and fiddle while Rome burns (or, in this case, remain calm and keep a long-term view), you might be more likely to ride out a period of volatility and uncertainty without incurring significant losses.

Seek professional help

In the aftermath of the great fire, Nero reportedly sought guidance from the Vestal Virgins, priestesses of Vesta who were entrusted with tending the sacred flame of Rome, a symbol of the city’s resilience.

These wise women offered Nero much-needed counsel and solace during a time of crisis. While Nero was undoubtedly a despicable character in history, he did help the city prosper somewhat after the fire, and the advice he received might have spurred him to make the right choices.

In the same vein, seeking professional financial advice during a period of market uncertainty could also be a wise move.

A financial planner can act as an impartial sounding board. They can reassure you, remind you of your long-term financial plan, and help you stay focused on your goals rather than reacting impulsively to short-term market fluctuations.

Moreover, a planner could help you build a goals-based financial plan, ensuring that your investments are aligned with your future aspirations.

They might even be able to guide you in building an emergency fund and maximising your pension contributions. These steps could strengthen your financial security and better prepare you for future volatility.

Get in touch

If you find it challenging to “fiddle while Rome burns” and would like help staying calm in the face of downturn, please email us at info@investmentsense.co.uk or call 0115 933 8433 to find out more.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.