Putting money aside to cover the cost of later life care should form part of any long-term financial plan.

Putting money aside to cover the cost of later life care should form part of any long-term financial plan.

And yet a recent report from the FTAdviser suggests that only one in five Britons has considered, and made provision for, care they might need in later life. Just 6% of those surveyed felt they were wealthy enough to meet care costs, with 29% looking to their property to fund care.

With the UK in the middle of a social care crisis, factoring in the cost of care is more important than ever. But is using your home the best way to do it? And how can we help find the right alternatives for you?

Why you might need to pay for long-term care

Research released last year by Age UK confirmed that as life expectancy rises, the number of individuals with complex care needs can be expected to rise too. As more of us live beyond age 85, pressure on the social care system is set to intensify.

You might end up footing the bill for care yourself. This might be because:

- Your assets exceed £23,250 (£28,500 in Scotland and £50,000 in Wales)

- You’re making up a fee’s shortfall while your local authority funds care during a deferred payment agreement period

- You want to improve your care at home by paying more

Where will your care fund come from?

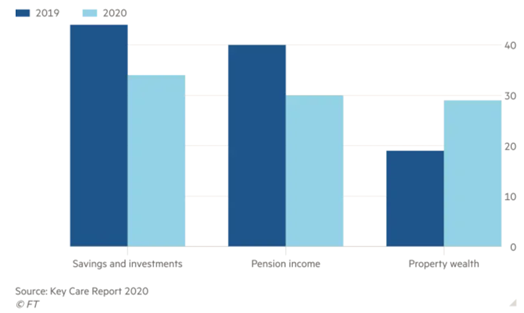

The FTAdviser reports a 10% increase in the number of people who anticipate using their home to help fund care, up from 19% to 29%.

Equity release is a way of unlocking the equity tied-up in your home.

The two main ways you might choose to do this are through a lifetime mortgage or a home reversion plan.

- Lifetime mortgage

If you use equity release to take a lifetime mortgage, you receive a lump sum or regular payments in the form of a loan, but you don’t make any repayments.

Instead, the accumulated interest is added to your mortgage debt and the full amount is deducted from the value of your estate when you die or enter long-term care.

- A home reversion plan

If you opt for a home reversion plan, you sell all or part of your property at a low market value. You no longer have sole ownership of your home, but you can continue to live there and receive care there too.

The scheme provider will take back their share of your property when it is sold, with the remaining percentage going to your estate. Equity Release reduces the value of your estate and can affect your eligibility for means-tested benefits.

Other options are available so speak to us before you make a decision and consider all other options.

Consider using pensions and investments instead

A good long-term financial plan will have considered the impact of the unexpected – whether an accident, illness, or the need for care. Planning in advance means peace of mind that the money is there, whether you need it or not.

The cost itself will vary greatly depending on where you live and your specific needs. Paying for Care states that ‘the average cost of a residential care home in the UK, in 2019, was £33,852 a year. This rose to over £47,320 a year when nursing care was included.’

If you don’t want to use your home to help fund care, you’ll have several options:

- Use investments

Investing in an ISA specifically to fund later life care could be a good option. If your estate is liable for Inheritance Tax (IHT) though – and it transpires that you don’t need to use your ISA fund for care – you could be heavily taxed, reducing the amount your loved ones are left with.

- Use your pension

Earmarking pension funds can be a good way to cover the cost of potential later life care. This is because the money that remains in a pension can often be passed on tax-efficiently.

If you die before the age of 75 and your beneficiary withdraws the funds within two years, they will not be taxed. If you die after the age of 75, withdrawals may be subject to Income Tax but not IHT.

- Use a trust

Assets placed in a trust are outside of your estate for IHT purposes. Trusts are complex, but when set up correctly, they can allow you to stipulate what will happen when you pass away, as well as how the trustees can use your money.

Speak to us if you are considering setting up a trust to fund your care and we can help ensure it is right for you.

Get in touch

By thinking about the potential cost of later life care early on, you can think about the different types of care you might need and understand how each scenario would be covered.

Although increasingly popular, using property won’t be right for everyone. There are many different ways to fund care. There is no right way, but there will be a way that is best for you.

If you’d like to discuss putting money aside to cover the cost of your later life care, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

Equity Release will reduce the value of your estate and can affect your eligibility for means-tested benefits.