Originally, there was no trust mechanism in the law.

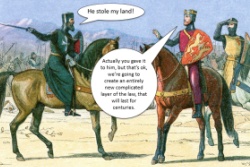

When landowners left England to fight abroad, they conveyed ownership of their land to someone in England to manage the estate on the understanding that it would be conveyed back to them when they returned.

On returning, sometimes the individuals they transferred the land to refused to transfer it back. They were the absolute owners, and under the existing law, the original owners had no way of getting their land back.

They had to petition the king, and the issue was decided based on what was fair (equitable) in the circumstances. This gave rise to a subsection of the law, sitting alongside the more formalised law, called “the law of equity”. This is what governs trust arrangements.

What does this mean for you, and how can Harpenden Building Society help?

We are very much an advocate of making the complex as simple as possible, which is why our accounts are fair, straightforward to understand, and simple to manage. We make the application as easy and as pain-free as possible.

What is a trust?

A trust is a legal arrangement where one or more trustees hold funds or assets for the benefit of one or more beneficiaries. There are different reasons for a trust to be set up, and so there are different types of trust. What type of trust you use is largely up to the settlor.

Who are the key parties?

- Settlor – This is the person or entity who creates the trust and makes a gift to it. They can also be known as the “donor”, “grantor”, “trustor”, or “trust maker”. They legally transfer control of an asset to a trustee, and they decide who the trustees and beneficiaries will be.

- Beneficiaries – These are the people that the settlor wants to receive the money that they have put into the trust.

- Trustee(s) – The person/people with responsibility for managing the trust and administering it for the purposes specified by the settlor for the benefit of the beneficiaries.

What is a trust deed?

The trust deed will give a name to the trust. It will also name the settlor and will show the date that the trust was created.

Trustees and beneficiaries will also be named, as well as a solicitor firm if necessary. In some cases, the settlor’s will replaces the need for a trust deed.

The trust deed sets out the rules for the trust to operate within and that all trustees must follow. All withdrawals and any closures with us will need to be part of the rules of the trust deed.

If the trust deed is changed, you must give us a copy of the deed of amendment or retirement. If this has happened before you open an account with us, you should give us these documents when applying for a trust account.

The different types of trust, explained

Will trusts

- A will trust is any trust created by an individual’s will.

- They may be used to reduce Inheritance Tax.

- The settlor’s will document replaces the usual trust deed.

Charitable trusts

- They can be created for an educational or scientific purpose, as an example, and are organised as a legal charity.

- They must have a charitable purpose and public benefit.

- As a charity, they won’t need to pay tax on most kinds of income or gains.

- The Charity Commission is able to provide advice on charitable trusts.

Personal injury trusts

- The source of the trust funding defines this type of trust.

- They are funded by an award of compensation for a personal injury.

- The settlor or person funding the trust will usually be the injured party.

- Personal injury trusts may be set up as bare, life interest or discretionary trusts.

Life interest trusts

- Beneficiaries are known as “life tenants”.

- Income will be paid to one or more beneficiaries in fixed proportions.

- At the end of a defined period of time, such as when the beneficiary dies, their life interest will end.

- At the end of one life interest, another beneficiary will become entitled to the trust assets. At this point, they will be granted their own life interest.

Simple/bare trusts

- The beneficiary has a right to both income and capital from these types of trust. The beneficiary also has a right to withdraw all the income and capital if they are 18 or over (16 or over in Scotland).

- The beneficiary is entitled to take ownership and control of the trust.

- Trustees act as nominees for the beneficiary and must act according to their instructions.

Discretionary trusts

These are where the trustees can make certain decisions about how to use the trust income, and sometimes the capital. Depending on the trust deed, trustees can decide:

- What gets paid out

- Which beneficiaries to make payments to

- How often payments are made

- Any conditions to impose on the beneficiaries.

Discretionary trusts are sometimes set up to put assets aside for:

- A future need, like a grandchild who may need more financial help than other beneficiaries at some point in their life

- Beneficiaries who are not capable or responsible enough to manage money themselves.

How can you open and manage a trust account with Harpenden Building Society?

To open a new trust account, we need:

- A completed trust application. This can be completed online or by completing a relevant application form.

- A trustee to sign the application form on behalf of all trustees. This includes an “execution only” declaration.

- A copy of the trust deed or will.

- ID for all trustees and beneficiaries. Normally, this will be done electronically, but if this is not possible (or a beneficiary is under the age of 18) then identification will need to be provided.

Get in touch

If you need some assistance with trusts, Harpenden Online would love to help. Alternatively, they can send you a passbook if you prefer post correspondence.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning, cashflow planning, tax planning, trusts, Lasting Powers of Attorney, or will writing.