Over the past few years, waves of uncertainty have swept over markets around the world. While it can often be concerning to watch the value of your investments fall, it’s often wise to ignore these short-term downturns.

Rudyard Kipling, the revered English writer, captured this sentiment perfectly in his poem, ‘If–’. He wrote:

“If you can keep your head when all about you are losing theirs …

If you can wait and not be tired by waiting …

If you can think – and not make thoughts your aim …

If you can trust yourself when all men doubt you …

Yours is the Earth and everything that’s in it.”

While his wise words are slightly archaic today, you can still glean wisdom from his insightful poem about keeping your head during periods of uncertainty, even when those around you seem to be panicking – a sentiment that’s certainly valid when it comes to investment markets.

In fact, CNBC even reveals that Warren Buffett referred to the poem in a 2017 Berkshire Hathaway shareholder letter.

He used it to highlight the fact that market downturns are inevitable, and rather than closely watching the market and reacting to any short-term movements, it’s prudent to keep a level head.

So, as 30 December is the anniversary of Rudyard Kipling’s birthday, now may be the ideal time to explore why it’s so important to ignore short-term market downturns.

The longer you invest, the less risk you typically face of losing money

Even though all investments carry some level of risk, and their value can fall as well as rise, it’s important to remember that the ups and downs of the market tend to smooth out over the long term.

This means that, typically, the longer you invest, the less risk you have of losing money. This is why investing for a minimum of five years is often wise.

Data from Nutmeg shows just how much your risk of losing money falls overall when you invest over longer periods of time.

Indeed, if you invested your money in the global stock market on a random day between 1971 and 2022, and then held onto that investment for two years, your historical probability of loss would be roughly 20%.

Meanwhile, if you retain the same investment for 10 years, your odds of losing money would drop to almost 5%. Hold onto it for 15 years, and your probability of loss would fall even further to almost 0%.

Time in the market, not timing the market

If you’re closely following market movements and witness a sudden drop in value across the board, it may be somewhat tempting to sell your investments in a knee-jerk reaction to cut your losses.

You may even sell your investments with the intention of buying them back when markets stabilise. After all, everyone wants to “buy low, sell high”, but in reality, this is often much easier said than done.

Even if you miss out on only a handful of the market’s best-performing days, the value of your portfolio could decline significantly.

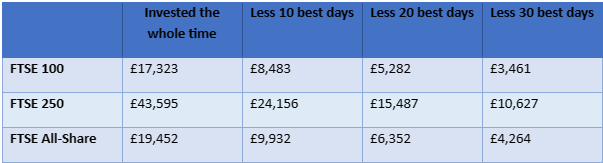

The table below shows the returns from an investment of £1,000 in some of the UK’s largest stock market indices between 1986 and 2021, based on leaving your money invested and missing some of the best days:

Source: Schroders

Please remember that past performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested.

If you had invested in the FTSE 250 – an index of the 250 largest companies in the UK by market capitalisation – and missed just 30 of the best days in the above 35-year period, this would have cost you almost £33,000 in potential returns.

This highlights the fact that, if you attempt to time the market and sell your investments when they start dropping in value, you could miss out on some of the market’s best days and hamper the overall performance of your portfolio in the process.

Instead, it may be prudent to stay the course and have faith in your long-term investing strategy.

Historically, markets tend to recover in the long term

While it can often be alarming to witness the value of your investments fall, it’s important to remember that markets typically recover over time.

Indeed, short-term fluctuations are completely normal. Take the last few years, for example.

Several events, namely the Covid-19 pandemic and the war in Ukraine, have caused markets around the world to decline somewhat.

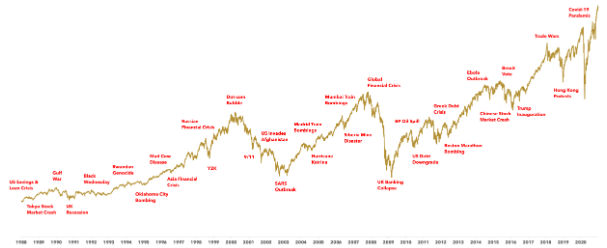

That said, historical long-term market data shows that markets have always recovered eventually. The graph below shows how significant world events can cause stock markets to decline, based on the MSCI World Price Index from 1988 until the end of 2020:

Source: Humans Under Management

While significant events have resulted in sharp declines through the years, the graph shows that the general trend of markets has been upwards over the past 30 years.

There are even events called market corrections, which is when there is a 10% drop in value across the market, and data from Schroders shows that these are more common than you may think.

Indeed, the US market has fallen by at least 10% in 28 of the last 50 calendar years. Even with these dips, the market has returned 11% a year over the last 50 years on average.

How to ignore emotions when managing your investments

Now that you know why it’s so essential to ignore short-term market uncertainty, you’re likely wondering how best to ignore your emotions.

This can often be easier said than done, so read on to discover how you can effectively focus on the future.

Focus on the long term

It is completely normal to expect some degree of volatility when you invest. Though, it’s essential to keep in mind that you’re investing for the long term.

To block out short-term noise and focus on the long term, it may be worth setting yourself goals, such as saving for a deposit or bolstering your retirement fund.

You could even divide your goals into medium- and long-term targets so you can manage your investments around what you want to achieve at various stages of your life.

Don’t keep checking your portfolio

When your money is on the line, it can be tempting to constantly check on the performance of your investments, especially during periods of uncertainty.

However, doing so can often leave you more stressed, and the benefits of repeatedly reviewing your portfolio are rarely worth it – you can apply the phrase “a watched pot never boils” to your investments.

Instead, it may be wise to set specific days to check your portfolio, perhaps once a week or twice a month.

Seek financial advice

Ignoring short-term market uncertainty is often more challenging than you’d think, especially if you have invested a significant sum of money.

This is where professional advice can help. We could assist you in devising an investment strategy that reflects your goals and takes your attitude towards risk into account.

What’s more, we can use long-term market observations and detailed breakdowns of market forecasts to structure your investment strategy in a way that suits you.

This could help you focus on your goals and give you much-needed reassurance that your investments still work for you and your needs.

Please contact us via email at info@investmentsense.co.uk or call 0115 933 8433 to find out more.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your capital is at risk. The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.