The extent of the Chancellor’s borrowing so far this year has been widely reported. Back in July, as Rishi Sunak looked to claw back some of his coronavirus spendings, he ordered a review into Capital Gains Tax (CGT). The Office of Tax Simplification (OTS) has now completed its review, making eleven recommendations.

The extent of the Chancellor’s borrowing so far this year has been widely reported. Back in July, as Rishi Sunak looked to claw back some of his coronavirus spendings, he ordered a review into Capital Gains Tax (CGT). The Office of Tax Simplification (OTS) has now completed its review, making eleven recommendations.

The proposed changes could double the number of people paying the tax, bringing in an estimated £70 billion over the next five years.

What could the changes mean for you? How much might you have to pay? And what does it mean for your long-term financial plans?

The Chancellor hopes simplifying the system could help cover the cost of the pandemic

According to reports from The Office for Budget Responsibility (OBR), government debt could reach upwards of £300 billion this year.

Before the crisis hit, the government was expecting to borrow around £55 billion.

As the second England-wide lockdown was announced, Sunak announced the extension of the furlough scheme in his latest round of measures to protect jobs. But the measures are expensive, leaving a large hole in the public finances.

CGT was one area where it was predicted changes might be made. The tax was paid by around 276,000 in 2018/19, amounting to £9.5 billion. This compares to almost £200 billion brought in by Income Tax.

The Office of Tax Simplification makes eleven recommendations

The Treasury-backed OTS has made a total of eleven recommendations. Here are three of the most significant:

- Align CGT with Income Tax

One much-anticipated recommendation that the OTS has made is to align the CGT rate with Income Tax rates.

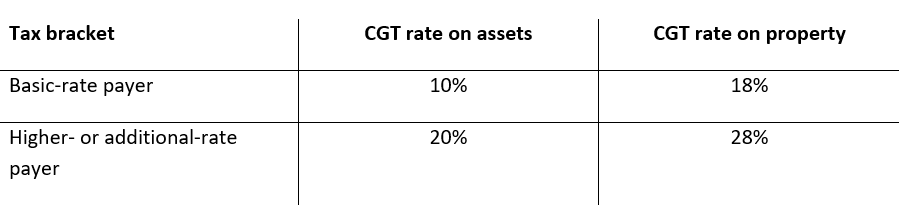

Under the current system, Basic-rate income taxpayers can be taxed at 10% instead of 20% for gains on asset sales, and 18% instead of 20% on any gains made on a second home or investment property sales.

For higher-rate taxpayers, CGT is currently 20% on asset sales and 28% on property sales.

Raising the tax payable in line with Income Tax – 20% for Basic-rate, 40% for higher-rate, and 45% for additional rate taxpayers – would clearly have a large effect on the amount of tax received.

- Reduce the CGT Allowance

The CGT Allowance is the amount of profit you can make from an asset in a given tax year without having to pay CGT.

For the 2020/21 tax year, the CGT allowance stands at £12,300 for an individual.

The OTS report recommends dropping the allowance to between £2,000 and £4,000. It anticipates this change raising an extra £14 billion a year. This reduction would mean that the number of people paying the tax each year would more than double.

- Remove the Inheritance Tax (IHT) ‘uplift’ rule

Under the current IHT ‘uplift’ rule, inherited assets are valued when someone dies. The person inheriting the asset – often a surviving spouse or civil partner – does not pay gains made during the time the deceased person owned it.

For example, if you inherit a £500,000 portfolio, which was once worth £300,000, the £200,000 gain is wiped. If you go on to sell the portfolio, the £500,000 figure is used as the base value and you’ll only pay CGT on any gain made above that amount.

Under the OTS recommendations, the CGT payable would be calculated from the original portfolio value of £300,000, significantly increasing the CGT payable.

What can you do to mitigate the impact of the proposed changes?

The best way to avoid a large CGT bill if the new changes come into effect is to make the most of tax-efficient allowances that exist elsewhere.

- Make the most of your pension Annual Allowance

Pensions are tax-efficient. You receive tax relief on contributions up to your Annual Allowance and can withdraw 25% of your fund tax-free when you retire.

For 2020/21 the Annual Allowance is £40,000 (or 100% of your income if lower) so be sure to make the most of this allowance each year. You can also carry forward any unused allowance from the last three tax years.

Be aware though that if you’re a high earner or you have already accessed some Defined Contribution benefits, your allowance might be lower. Speak to us if you’re unsure which allowance applies to you and we can help you make the most of your tax-efficient pension savings.

- Make the most of the ISA Allowance

ISAs are also incredibly tax-efficient. The ISA Allowance stands at £20,000 for the 2020/21 tax year.

You don’t pay tax on any interest you earn in a Cash ISA and any gains you make on investments in a Stocks and Shares ISA are free of both Income Tax and Capital Gains Tax (CGT).

You can’t carry forward unused allowance so if you don’t use it, you lose it.

- Speak to us

There were eleven recommendations in the OTS report, and it remains to be seen which the Chancellor will adopt.

If you already make full use of your allowances each year, you might be looking for other ways to avoid a potentially large CGT bill if and when the changes come into effect.

We are all individuals, and no two solutions will be the same. We can help you to look at your finances as a whole and work out a financial plan that aligns with your long-term goals and aspirations, making sure the plan we put in place is right for you.

Get in touch

If you’d like to discuss any aspect of the proposed CGT changes and a potential future liability, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

Investments carry risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Financial Conduct Authority does not regulate estate or tax planning. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.