Interest rates have been consistently low for a decade but are they set to drop? Whether you’re a saver or a borrower, the interest rate the Bank of England sets will have an impact on your money.

Interest rates have been consistently low for a decade but are they set to drop? Whether you’re a saver or a borrower, the interest rate the Bank of England sets will have an impact on your money.

What is the Base Rate?

The Bank of England sets the base rate for the UK. This sets the amount of interest that banks pay when they are lent money by the Bank of England and the costs of these changes are likely to be passed on to consumers.

This affects your finances in two key ways: it alters the amount of interest you earn on your savings and the amount it costs you to borrow money.

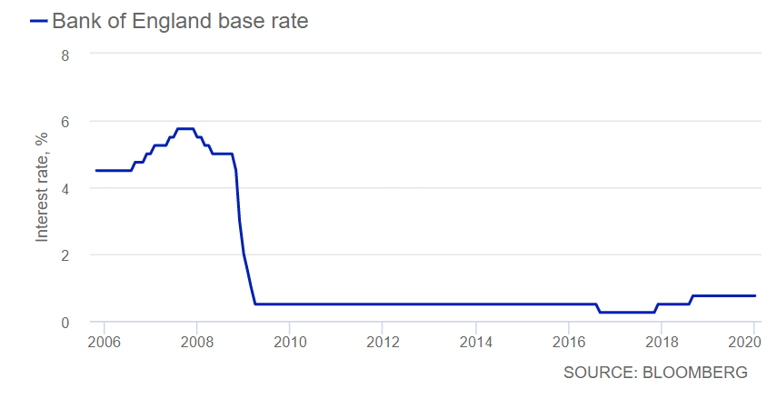

The base rate fell dramatically following 2008’s global financial crisis but it had crept up, albeit slowly, since late 2018.

At the end of last year, hopes were high that the interest rate might be about to rise. Increasingly though, following the most recent meetings of the Monetary Policy Committee (MPC) and comments made subsequently by at least three Committee members in the press, the sands have shifted, and the odds are now in favour of a rate drop.

Why might it be dropping?

Figures released by the Office of National Statistics (13 January 2020), showed a 0.3% drop in the economy leading up to last December’s General Election. The GDP drop was put down to a fall in manufacturing and has led – alongside those comments made MPC members themselves – to a drop in sterling.

Mr Carney, Governor of the Bank of England since 2013, is set to leave the position in March. Speaking to the Financial Times, he warned that with many of the tools at the Bank of England’s disposal already being used, there was a limit on what the central banks could do in the event of a further economic downturn. There was though, he said, scope to cut the base rate.

In a Telegraph interview, Bank of England policymaker Michael Saunders also called for the uncertain economy to be met with a “relatively prompt and aggressive response”.

What impact does a rate change have on you?

A change of base rate will impact all our finances. Here, we break down the effect of a Bank Rate change across different areas of the market.

Savings

If you have savings, it’s already been a difficult decade. Interest rates were cut significantly following 2008’s global financial crisis and they have remained low ever since. With This is Money reporting that the average interest paid on an easy access account is just 0.59%, the minimal interest gained on your money is falling significantly behind inflation.

It’s been a difficult few years for savers and an interest rate cut would likely only prolong the agony.

If you are being paid a fixed rate of interest on your savings, then any fall in the base rate won’t affect you straight away.

Mortgages

In general terms, the effect of a reduction in the base rate on your mortgage would be that your repayments would be expected to fall (if you have a variable-rate or tracker mortgage).

On a £200,000 repayment mortgage over a term of 25 years, a reduction in the interest rate from 2% to 1.75% would see repayments fall by approximately £24 per month.

If you’re on a fixed-rate mortgage, your repayments won’t change.

Investments

Investopedia.com explains the impact of interest changes on bonds: ‘Bond prices are inversely related to interest rates. When interest rates go up, bond prices go down, and vice versa’.

For other investments, it would be anticipated that a lower interest rate would, according to Barclays, ‘…in theory at least… encourage both consumers and corporations to borrow, spend and invest more. This, in turn, can potentially lead to stronger economic growth, higher share prices and rising inflation, as more money is pumped into the economy’.

A fall in base rate would, therefore, be expected to lead to bond prices and share prices going up.

Other borrowing

In theory, if you’re borrowing in the form of credit cards or personal loans, you should see interest rates reduce in the event of a base rate decrease.

However, according to Moneyfacts, reducing interest rates hasn’t stopped credit card providers increasing the interest they charge customers who don’t pay off their bill in full each month. The average rate for those making credit card purchases hit 24.7% in September last year, the highest since the company started charting the figures back in 2006.

Uncertainty prevails

Amidst the predictions of a base rate fall, there are also those predicting that the rate will remain the same (at time of writing, few are predicting a rise).

Until the next meeting of the MPC and the outcome of their vote, nothing is guaranteed. Add to that the uncertain effects of a changing rate, within the context of outside factors like Brexit and US foreign policy, the only thing to be sure of is that nothing is certain!

Get in touch

If you’d like to discuss the effect of a base rate reduction on your finances, please get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.