In recent months, you’ve probably seen lots of headlines about the government’s plans for economic recovery in the wake of the coronavirus pandemic. If you have, you’ve probably encountered the phrase “quantitative easing”, but it isn’t immediately clear what this is.

In recent months, you’ve probably seen lots of headlines about the government’s plans for economic recovery in the wake of the coronavirus pandemic. If you have, you’ve probably encountered the phrase “quantitative easing”, but it isn’t immediately clear what this is.

According to government figures, the Bank of England’s quantitative easing programme is set to cost £895 billion by the end of 2021. This is a considerable sum that is being pumped into the economy and could have many financial consequences.

If you want to know more, here is everything you need to know about what quantitative easing is and what it could mean for you.

The coronavirus pandemic caused the UK economy to contract significantly

As you may remember, one of the biggest consequences of the pandemic was that many businesses were forced to close when the government implemented the national lockdowns. While these measures helped to slow the spread of the virus, they had a significant economic impact.

According to figures from the Office for National Statistics (ONS), published in the Guardian, the UK economy shrank by 9.9% in 2020. Supposedly, this was the biggest fall in annual GDP since the “Great Frost” in 1709.

To help limit the impact on the economy, the government borrowed significant amounts of money to support businesses and workers. For example, the furlough scheme was a vital lifeline for millions of Brits, as it allowed them to continue to pay their bills while they were unable to work.

The government also provided loans and grants to businesses that were particularly impacted by the lockdowns, such as pubs and restaurants.

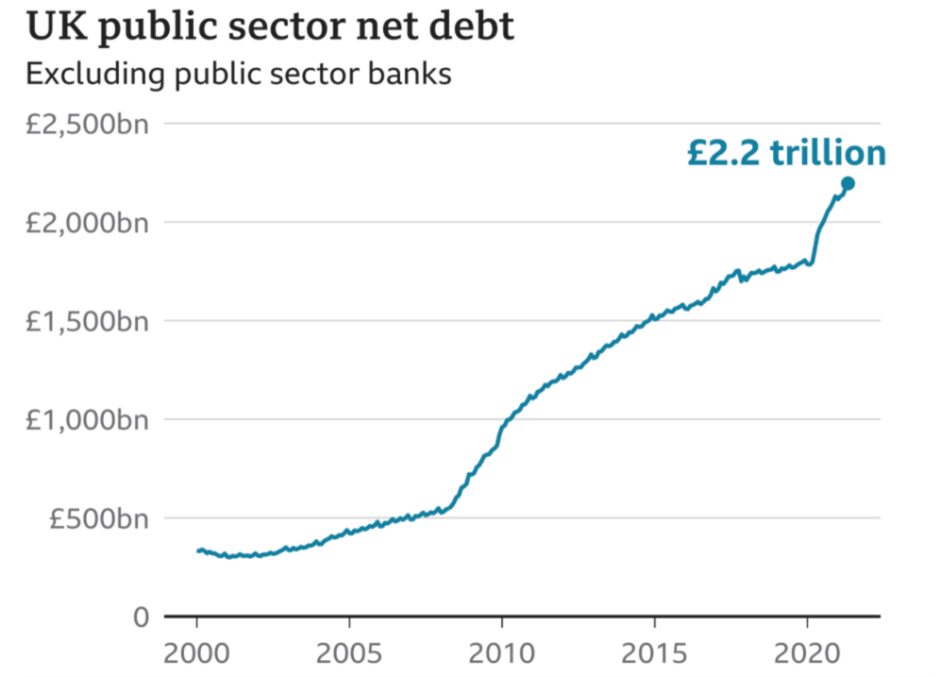

While this economic support helped many Brits to keep their heads above water, it came at a significant cost. According to figures from the ONS, published in the BBC, government debt rose to £2.2 trillion in July 2021.

Source: BBC

In order to cover the cost of the government’s policies, the Bank of England implemented quantitative easing to help ease their burden.

Quantitative easing essentially involves the Bank of England buying government debt

The Bank of England is responsible for the amount of money that’s in the UK economy at any given time. One of the main benefits of this is that it can increase or decrease the amount of money in circulation, depending on what is needed.

Typically, when the government needs to raise money, it sells bonds known as “gilts”. These bonds promise to repay the bearer the value of the original bond, plus interest.

Essentially, quantitative easing involves the Bank of England buying up a large amount of these bonds. As a result of this increased demand, the price of the bonds rises which, in turn, causes the interest rate that these bonds pay to fall.

This has a knock-on effect, as the price and yield of government bonds typically influences the interest rates offered by many. This means that the interest rates from lenders is reduced, making it cheaper for people and businesses to borrow money. The resulting spending helps to stimulate the economy.

Furthermore, if the price of bonds rises and the interest they earn falls, this makes them a less attractive prospect for private investors. Due to this, it encourages them to buy shares or lend to businesses, which also helps to stimulate economic activity.

Quantitative easing tends to boost the value of assets such as shares or property

As you can imagine, one of the main results of quantitative easing is that it tends to affect the price of assets, such as shares and property, since there is more money in circulation.

This can be good news for homeowners, since it leads to an increase in house prices. As you may have seen, in recent months the UK housing market has undergone a “mini-boom”. According to the ONS, house prices increased by 13.2% in the year to June 2021, despite the economic fallout of the coronavirus pandemic.

Of course, this effect of quantitative easing has also made it difficult for younger people to take their first step onto the property ladder without the help of their parents.

There is also some debate over the full impact of the strategy on the economy at large. Since it was first implemented in the wake of the 2008 financial crisis, it’s hard to accurately judge its long-term impact.

According to one expert in the FTAdviser, one downside of quantitative easing is that since it causes house prices to rise, young people have to save for longer. This means that their spending power is reduced and so they are less able to stimulate the economy.

Get in touch

If you want to know more about how the government’s financial policies may affect you, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.