January is the perfect time to plan for the year ahead. Whether financially or personally, everyone has ambitions and concerns to consider over the next 12 months. While nobody can predict the future, it’s always wise to have plans in place for the unexpected.

As such, a recent poll by interactive investor asked 1,900 users what their biggest financial concerns were for 2022. At the top of the list was the potential of a stock market crash.

The second biggest concern was the rising cost of living, with the third being rising taxes.

But on what scale are these concerns likely to materialise, and what can you do to overcome them if they do? Continue reading to find out.

1. Stock market crash

Investors are worried about a stock market crash in 2022 and the effect it may have on their portfolio and returns. The concern is understandable, especially when so many invest part of their savings on the stock market.

Some experts are predicting a turbulent 2022 due to stunted economic recovery in some major international markets and increasing geopolitical tensions, but they are unsure whether a market crash is likely to occur.

Mark Haefele, chief investment officer at UBS Global Wealth Management, has a positive outlook on the coming year. He told the Guardian that “global economic growth is likely to remain above trend for the first half of 2022,” which will hopefully help to avoid significant market problems.

The Motley Fool defines a stock market crash as times when there is a significant decline in general stock prices, usually when major stock market indexes lose more than 10% of their value in a short period.

A crash is usually perpetuated by investors who notice the decline and panic-sell their stocks to minimise losses. While a crash can cause short-term economic stress, the effects don’t often last for a long time.

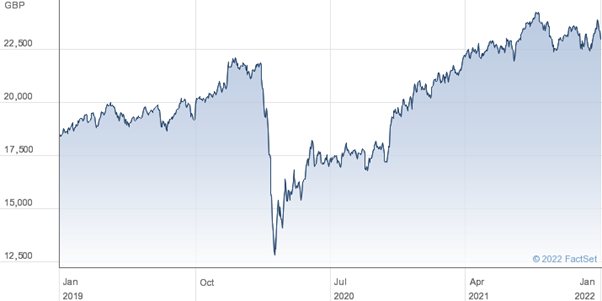

As an example, the FTSE 250 suffered a significant fall in early 2020 with the onset of the Covid-19 pandemic but has since recovered. In fact, as you can see from the chart below, the UK stock market is already in a stronger position than before the pandemic started.

Source: Hargreaves Lansdown

Whether a stock market crash actually happens or not, it is worth remembering that investing is a long-term endeavour. Your capital is at risk. The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested.

The stock market is highly volatile by nature and can experience periods of uncertainty at any time. Past performance is not a reliable indicator of future performance. However, history has shown that it usually recovers in time.

As such, it is vital to structure your investments according to your risk profile. High-risk investments may give the chance for higher returns, but also come with more volatility. Low-risk investments have less opportunity for stellar returns but are also more stable and you’re less likely to see long-term losses.

2. The rising cost of living

The second biggest reason for concern among interactive investor users is the rising cost of living.

The Office for National Statistics reports that inflation stood at 5.1% as of November 2021. This is the highest it has been for 10 years, and it is predicted to rise even higher in the early months of 2022.

Inflation is the rate at which prices rise, meaning that the cost of your weekly shop in November 2021 was, on average, 5.1% more expensive than in November 2020. Over time, rising prices can erode the value of your cash savings, since you are able to buy less with your money.

One significant factor contributing to the rising cost of living is the ongoing European energy crisis. Energy prices across the continent are continuing to rise, and a sharp increase in the energy price cap is expected in April. According to the BBC, this could increase energy bills by about 50%.

The Guardian warns that more than 6 million UK homes may be unable to pay these higher energy bills.

Additionally, in a bid to bring inflation under control, the Bank of England has raised the base rate. This is likely to increase the rates of mortgages and other loans, further pushing up the cost of living.

If your finances feel a little squeezed at times like this, consider working with a financial planner to create an effective budget and plan for further rising costs. We can be there to help you prepare for financial difficulty without jeopardising your standard of living or future savings.

3. Tax increases

The third biggest financial concern for 2022 is the potential for tax increases, especially since so many tax allowances have already been frozen.

One example is the Income Tax freeze, which is set to be in place until 2026. This may cause more people to slip into higher tax brackets as salaries rise during the emergence from the pandemic.

The Capital Gains Tax exemption is also frozen until 2026, which could catch investors off guard and mean you may pay more tax when selling stocks that are not kept in an ISA.

Also frozen is the Inheritance Tax threshold, meaning that your estate could pay more tax on your death than you expect, and leaving less for your loved ones to benefit from.

The pension Lifetime Allowance is also frozen until 2026, which may result in more people paying the tax charge on pension withdrawals above the threshold.

Lastly, the Health and Social Care Levy is due to take effect from April 2022, which will increase your National Insurance bill by 1.25 percentage points.

To ensure you aren’t paying too much tax on your wealth, and to make the most of any available tax breaks, consider working with a financial planner. We can help grow and protect your existing wealth with your financial and personal goals in mind.

Work with a professional to manage your investments

If you have financial worries for 2022, speak to us. We can help you prepare for possible financial hardship and rising costs with the aim of continuing to grow your wealth.

Please email info@investmentsense.co.uk or call 0115 933 8433 for more information.