These days, many people are far more aware and conscious of ethical issues, such as the climate crisis. In fact, figures from the Office for National Statistics show that 64% of adults in the UK have felt very worried about the impacts of climate change in the past 12 months.

This could be why individuals across the country have been searching for more ways to invest their wealth sustainably.

One of the ways you could do so is through environmental, social, and governance (ESG) investments and funds, and they’re certainly becoming more and more popular.

Indeed, PwC states that asset managers globally are expected to increase their ESG-related assets under management from $18.4 trillion in 2021 to $33.9 trillion by 2026.

However, while ESG investments could allow you to align your wealth with your morals and beliefs, there are several potential issues with ethical investing.

Continue reading to discover precisely what constitutes investing sustainably, and two challenges you may face if you wish to build an ESG-friendly portfolio.

ESG investments mean allocating your wealth to ethical companies and funds

As mentioned, ESG investments allow you to invest sustainably in companies that follow ethical practices. This is where the name “ESG” comes from, as it stands for:

- Environmental – This is how a company’s operations affect the environment, and the measures it takes to reduce its impact. It could include systems for managing waste effectively or using renewable energy.

- Social – This identifies what the company’s relationship with its employees and its community looks like, and can deal with issues such as the treatment of its staff, health and safety standards, or any charity work.

- Governance – This deals with how ethically the company is run on a day-to-day basis, and could focus on the behaviour of board members, the transparency of the company’s accounting, and its tax position.

If you are concerned about a particular issue, such as climate change, you may make simple changes to do your part, such as driving less or cutting energy use at home.

However, you may ultimately counteract your efforts if you’re still investing your wealth in companies that produce significant carbon emissions.

So, by investing in ESG companies that meet certain environmental criteria, your financial plan could support your ethical priorities and concerns, giving you the peace of mind that you’re trying to improve the world around you.

While this may sound like an attractive way to invest your wealth, it’s important to note that demand for ESG investments has seemingly declined in recent months. In fact, Money Marketing reveals that ESG funds saw outflows of nearly $2.5 billion in the last quarter of 2023.

This could be due to the fact that the ESG investment market inherently faces several challenges. Thankfully, there are some ways you can overcome them if you wish to build an ethically conscious portfolio – read on to find out how you could tackle two of these challenges.

Challenge 1: Greenwashing

Perhaps the primary issue facing ESG investing is the concept of “greenwashing”. This is essentially when a company or fund labels itself as more conscious and progressive than it actually is through false advertising or misleading information.

Worryingly, this could be more common than you think, as the Guardian stated that more than 160 “sustainable” pension funds held $4.5 billion in companies such as Chevron and ExxonMobil, despite these companies being responsible for significant carbon emissions.

Even some individual ESG-designated companies are guilty of greenwashing, one notable example being Volkswagen admitting to cheating emissions tests in 2015 by fitting vehicles with a “defeat device”. This piece of software could detect when it was undergoing a test, and then alter the performance to reduce emissions.

This was despite the fact that, at the time, the company was touting its vehicles’ low-emission and eco-friendly features in marketing campaigns. In reality, Volkswagen’s engines were emitting nitrogen pollutants up to 40 times above the US limit, the BBC reports.

You could have a false impression of the ethical impact of your investments if you believe you’re investing in a sustainable company or fund, but you aren’t really due to greenwashing.

How to overcome greenwashing

Instead of taking a company’s claims of its green credentials at face value, it may be worth doing your own research into a company before you invest in it.

By doing so, you may be able to spot some of the telltale signs of greenwashing and ensure you invest your wealth ethically.

For instance, you may be able to identify whether a company invests in unsustainable or environmentally damaging practices, such as fossil fuels. Similarly, you could figure out whether the company supports causes that drive positive change in the economy, namely recycling programmes or green energy initiatives.

Additionally, it can be prudent to keep an eye out for overly “green” language. It’s easy for a company to plaster words like “sustainable” and “eco” on its products and services, but this doesn’t necessarily mean that it’s a reliable ESG investment.

Genuinely sustainable companies can often demonstrate their dedication to ethical issues through their actions, rather than their words. Meanwhile, companies that greenwash cannot, so may rely on green language instead.

Challenge 2: Diminished returns

Another criticism often levelled at ESG investments is that you should accept lower returns in order to be ethical with your wealth.

This could be due to the fact that many of the largest companies in the world that tend to offer the best return on investment aren’t always the most ethical by ESG standards.

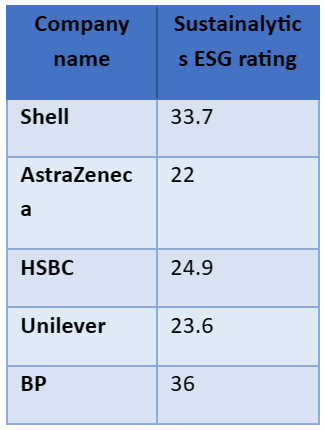

For instance, take this table showing the top five constituents of the FTSE 100 stock market index by market capitalisation, compared to their ESG rating:

Source: London Stock Exchange and Sustainalytics

Considering that Sustainalytics classes ESG ratings between 20 and 30 as “medium risk” and those between 30 and 40 as “high risk”, many of the top companies in the FTSE 100 have relatively poor ESG ratings.

Another reason some people believe that ESG investing isn’t always the best idea could be a result of negative press.

For example, many politicians, particularly in the US, have denounced ESG investing as the “politicisation of investing”.

Similarly, Tesla CEO, Elon Musk, labelled ESG investing as a scam after his company was removed from the S&P 500 ESG index.

How to overcome fears of diminished returns

If you’re determined to invest your wealth sustainably and are still worried that your wealth won’t grow, it’s important to note that ESG investing doesn’t always equate to diminished returns.

The Sustainable Reality Report published by the Morgan Stanley Institute for Sustainable Investing compared the performance of a wide range of funds.

The findings showed that, in the first half of 2023, sustainable funds generated growth of 6.9% compared to 3.8% from traditional funds – a small time frame, but an interesting result nonetheless.

Of course, it’s essential to remember that past returns don’t guarantee future performance, and the value of your investments could always fall.

Regardless, the data does indicate that fears of poor returns from ESG investments and funds may be unfounded.

It may be worth speaking with a professional before you invest your wealth

If you still have concerns, either about greenwashing or returns, it may be worth consulting with a financial planner.

We could help you design a portfolio that aligns with your values. On top of this, we can monitor the performance of your investments and ensure that you remain on track to achieve your future goals.

We could also ensure that the companies you’re interested in don’t engage in greenwashing, and are as sustainable as they claim.

To find out more, please contact us by email at info@investmentsense.co.uk or call 0115 933 8433.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.