The coronavirus pandemic has cost the government billions of pounds. From the Job Retention Scheme to a freeze on VAT and the Stamp Duty holiday, the Chancellor has huge sums to claw back if he is to rebalance the books.

The coronavirus pandemic has cost the government billions of pounds. From the Job Retention Scheme to a freeze on VAT and the Stamp Duty holiday, the Chancellor has huge sums to claw back if he is to rebalance the books.

The next Budget is sure to bring changes – whether to pensions or taxation. But you might already be feeling the economic impact of coronavirus on your long-term financial plan.

However your finances have been affected, professional advice can help you recover and adjust, ensuring you are still on course to achieve your long-term goals.

Here’s how the economic impact of Covid-19 might affect you in the future.

- Homeowners

Whether a furloughed worker on 80% pay or a business owner struggling to pay yourself dividends out of lockdown-hit profits, taking a mortgage holiday might have been your only option.

The Chancellor announced in March that lenders could take a three-month mortgage holiday if the coronavirus had affected their ability to keep up with payments. The government later extended the scheme – and the period of sign-up – by a further three months.

The FCA recently announced that mortgage payment holidays are coming to an end. Mortgage holders affected by coronavirus won’t be able to demand a break from mortgage payments after 31 October.

One in six of all mortgage holders in the UK took up the offer of a mortgage payment holiday. That’s 1.9 million households.

Whether you or a loved one chose to take a break from mortgage payments, you’ll need to be aware of the long-term ramifications.

A mortgage holiday is a deferment of payment. You still owe the money you haven’t paid and once the holiday comes to an end, you should expect your monthly repayments to rise. Your lender should contact you to let you know what your repayments will be once you start making them again.

You should also be aware that obtaining credit or switching mortgage providers in the future might be more difficult if you’ve taken a payment holiday.

When the Government made its announcement back in March, they confirmed that borrowers’ credit files would not be affected. Credit reference agencies such as Experian duly confirmed that an individual’s credit score wouldn’t be impacted.

Although this remains the case, lenders take other factors into account when approving a loan. Regardless of your credit rating, a payment holiday, taken for any reason, could be seen as a sign of financial strain.

- Pension savers

If you or a loved one were furloughed during lockdown, your pension contributions continued. It’s likely though, that contributions have been lower than they would have been.

The Job Retention scheme paid 80% of your salary (up to £2,500 a month) while also replacing your employer’s 3% pension contribution. The 3% paid did not include commission, fees, or bonuses, so any contributions made were calculated from your basic salary.

Not only that, they were based on 80% of your salary, and therefore would have been lower than usual. The £2,500 per month cap means that if you earn more than £30,000 a year, your pension contributions could have fallen significantly.

Irregular income or the threat of unemployment during the uncertainty of lockdown might have prompted you to suspend contributions altogether. That too could have consequences for the value of your savings at retirement, even if you have since restarted payments.

Speak to us if you have any concerns about the impact of coronavirus on the size of your pension pot and your future aspirations. We can look at your finances as a whole and help get you back on track.

- Investors

The short-term effects of coronavirus on the stock markets have been well publicised: record drops in the FTSE 100, Dow Jones, and S&P 500, a huge hit to GDP, and the end to a historic bull market run in the US.

Short-term volatility can lead to emotional, knee-jerk reactions. You might have been tempted to move or withdraw funds and you may even have gone through with it.

But remember that investment is a long-term prospect.

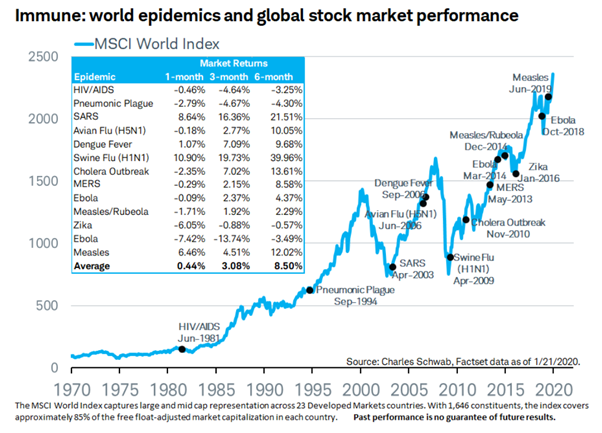

Earlier this year, Charles Schwab produced a graph showing the impact of various past epidemics on the stock market and the recoveries that followed.

The conclusion was that the ‘global economy and markets have been relatively immune to the effects of past viral epidemics. A short-term dip in stocks tended to be followed by the continuation of the upward trend.’

If you remained patient and kept your money invested, you benefited when the market recovered. Speak to us if you’d like to check how your investments are performing or you’re looking to make changes.

A diversified portfolio, invested for the long term, and aligned to your risk profile gives you the best chance of achieving your long-term financial goals.

Get in touch

If you’d like to discuss the impact of any potential changes on your finances, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note:

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.