As you make plans for your hard-earned wealth, helping your loved ones achieve their long-term goals might be your top priority.

Yet, one of the most significant challenges is doing so in a way that minimises a future Inheritance Tax (IHT) bill.

This is especially relevant given that the Office for Budget Responsibility expects IHT receipts to reach £9.1 billion in 2025/26.

When considering a significant transfer of your wealth to mitigate a potential IHT bill, you might have overlooked the “potentially exempt transfer” (PET) rule.

Continue reading to discover what PETs are and how they could help you mitigate an IHT bill.

The nil-rate bands dictate how much wealth you can pass to loved ones without incurring tax

Before you consider gifting your wealth, it’s important to understand the basics of IHT.

Your loved ones could be liable for IHT if your estate’s value exceeds the available “nil-rate bands”. These dictate how much wealth you can pass to your loved ones tax-efficiently.

As of 2025/26, these are:

- The £325,000 nil-rate band, which covers all of your assets, including property

- A residence nil-rate band of up to £175,000, provided you pass your main home to a direct lineal descendant, such as your child or grandchild.

These thresholds are frozen until 2031.

Combined, these could allow you to pass on up to £500,000 in assets if you include your family property without incurring IHT.

Better yet, you could combine these allowances with your spouse or civil partner, allowing you to leave a potential tax-free inheritance of £1 million.

Anything above this will typically face a 40% IHT charge.

There are several smaller gifting allowances available

To immediately reduce the overall value of your estate, you can make use of several gifting allowances and exemptions.

For instance, the “annual gifting exemption” allows you to give up to £3,000 in 2025/26 without it forming part of your estate.

You can also make tax-free gifts to loved ones getting married or starting a civil partnership. The value of your gift depends on your relationship with the couple. As of 2025/26, you could give:

- £5,000 to a child

- £2,500 to a grandchild or great-grandchild

- £1,000 to anyone else.

Moreover, the small gifts rule allows you to make as many £250 gifts as you like to someone, provided they haven’t already received an IHT-free gift from you under another allowance in the same tax year.

Alternatively, you could make regular gifts from your surplus income. These can be entirely free from IHT, but they must be made from your income, not from any savings or investments. They must also be given regularly and can’t affect your standard of living.

Making the most of these allowances can significantly reduce the tax burden on your next of kin.

Potentially exempt transfers could allow you to pass a potentially unlimited amount of wealth

The aforementioned allowances and exemptions let you give a significant portion of your wealth to loved ones, all while mitigating a potential IHT bill. Still, you may find that the total value of your estate quickly exceeds the nil-rate bands.

This may be especially significant given that pensions – which can be one of your largest assets – are set to form part of your estate for IHT purposes from 6 April 2027.

So, you could make the most of PETs to significantly reduce the overall value of your estate.

Simply put, PETs allow you to give a potentially unlimited amount of your wealth to a loved one, provided you survive for more than seven years.

For example, imagine you decide to gift a large sum to a child or grandchild to help them onto the property ladder or to fund their higher education.

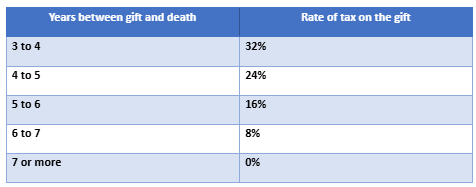

If you then live for seven years, the gift will typically fall outside your estate. However, if you pass away within this period, the rate of IHT your beneficiaries pay may be measured on a sliding scale known as “taper relief”.

The table below shows the different levels of tax you could pay depending on how long you live after making the PET:

As you can see, gifting your wealth as early as possible could give you the best chance of surviving beyond seven years and making your gift IHT-free.

However, it’s vital to note that PETs are usually the first element assessed against your nil-rate bands. Therefore, you generally need to use other exemptions first – for example, paying assets into trust or making considerable gifts – before your intended PETs would benefit from taper relief.

It’s worth speaking to a financial planner before you make use of potentially exempt transfers

You may now realise that PETs require careful consideration. Without proper planning, you could fall victim to a common error, and your family may end up paying more IHT than expected when they inherit your estate.

As a result, it might be prudent to speak to a financial planner before considering using PETs.

We could help you determine whether PETs would benefit your unique situation, and outline other ways you could gift wealth to reduce the value of your estate.

Moreover, we could use sophisticated cashflow modelling software to help forecast the impact that gifting your wealth might have on your financial security.

This could ensure you can afford to support your loved ones without inadvertently affecting your standard of living.

To find out more, please contact us by email at info@investmentsense.co.uk or call 0115 933 8433.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate estate planning, cashflow planning, or tax planning.

Remember that taper relief only applies to gifts in excess of the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.