In September 2021, the government announced two policy changes that could significantly affect you and your finances: both a National Insurance and Dividend Tax rise will come into effect in April 2022.

In September 2021, the government announced two policy changes that could significantly affect you and your finances: both a National Insurance and Dividend Tax rise will come into effect in April 2022.

However, small businesses and economists warn that these increases may create a rise in unemployment and hurt post-pandemic economic recovery.

But what exactly does the rise in National Insurance mean, and how will it affect you? Read on to find out more.

The National Insurance rise could affect both individuals and businesses

Although one of the main points of the Conservative manifesto in the last election was a promise not to raise taxes, a National Insurance will happen in the next tax year.

National Insurance contributions (NICs) will be rising by 1.25 percentage points for the self-employed, employers, and employees. The increased funding is supposed to go towards health and social care and will help with the introduction of the £86,000 care cap that will be brought about in April 2023.

This additional contribution will become known as the “Health and Social Care Levy” in 2023 and will be marked as a separate payment on employee payslips.

Plus, for the first time, this National Insurance levy will be paid by workers above the State Pension Age, which is currently 66 and will be rising to 67 in 2028. With the current system, individuals stop making NICs when they reach the State Pension Age.

The Guardian expects this change to result in 1.3 million pensioners paying NICs on their earnings.

Your payments will depend on your income

This new National Insurance levy and Dividend Tax rise is predicted to raise a combined total of about £12 billion a year, which will all be put towards health and social care in the UK. The amount you will pay towards this total is dependant on your income.

For example, according to the Guardian, a worker earning £30,000 a year will see their NICs rise from £2,451 to £2,707 a year, an increase of £255. However, a worker earning £60,000 will see their NICs rise from £5,079 to £5,709 a year, an increase of £630.

This means that if a working individual above State Pension Age is earning £60,000, they will go from paying £0 a year National Insurance, to £630.

If you own a business, your payments will depend on your employees’ income

If you own your own business, you will also need to pay increased contributions on your employees’ wages. This could significantly eat away at the available funds for small businesses.

In fact, SmallBusiness.co.uk report that the changes could cost small businesses upwards of £5.7 billion upon their introduction. They warn that these costs could put more than 50,000 UK jobs at risk, and that they could prevent the future creation of about 350,000 jobs.

Plus, if you are a sole trader, you need to organise your own National Insurance payments through self-assessment tax return. The amount you will pay is determined by your income.

For profits between £6,515 and £9,568, your Class 2 NICs will remain the same, at £3.05 a week, totalling £158.60 each year. For earnings between £9,568 and £50,270 a year, your Class 4 payments will rise from 9% to 10.25%.

For profits over £50,270 a year, these payments will rise from 2% to 3.25%.

This means that, according to Which?, for a sole trader earning £40,000 a year, their Class 2 and Class 4 National Insurance payments will total £3,277.88 in the 2022/23 tax year. This is up more than £380 on what they would pay in the 2021/22 tax year.

The Dividend Tax rise could also affect business owners and directors

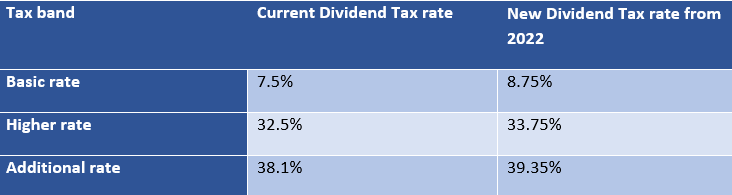

Lastly, a 1.25 percentage point rise in Dividend Tax could hurt company owners and directors who pay themselves in dividends. It could also affect a small number of investors who receive dividends from the companies they’re invested in.

There is a £2,000 tax-free allowance for dividend income, meaning that you will only pay tax on any dividend income above that threshold. The amount you pay is dependent on your tax bracket.

The increase means that a basic-rate taxpayer bringing home £4,000 worth of dividends will pay £175 in Dividend Tax, up from the £150 they would currently pay.

A higher-rate taxpayer earning £8,000 on dividends, for example, would pay £2,025 compared to the £1,950 they would pay now.

In simple terms, if you earn more than £2,000 in dividends each year, you will be paying more tax on your income.

Speak to a financial planner to better understand how you’ll be affected

If you’re worried that you might potentially run in to new tax issues, contact a financial planner to discuss your options. We can help you understand the situation you’re likely to find yourself in, and how to plan your finances for that eventuality.

Or, if you’re looking to find out in more detail exactly how you may be affected by the coming changes, please get in touch. Email info@investmentsense.co.uk or call 0115 933 8433 for more information.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.