The Income Tax threshold freezes and reductions of Jeremy Hunt’s autumn statement could mean that you pay more tax over the next few years.

In fact, FTAdviser reports that around 1.5 million Brits will be dragged into a higher Income Tax bracket by 2027/28. More than 300,000 of these will become additional-rate taxpayers, paying 45% tax on a portion of their income.

Freezing or reducing tax thresholds at a time of high inflation and rising wages increases the government’s tax take. This is good news for the Treasury – at least in the short term. It does, though, mean less cash in your pocket. In turn, this could lead to a downturn in consumer spending and make it harder for you to save toward your long-term goals.

Keep reading to find out what the chancellor’s Income Tax plans might mean for you and your finances in 2023/24.

Jeremy Hunt’s autumn statement extended the freeze on the Personal Allowance and reduced the higher-rate tax threshold

In his 2021 spring Budget, then-chancellor Rishi Sunak went ahead with planned rises to the Personal Allowance and higher-rate tax bands scheduled for 2021/22. He then, though, froze these amounts until 2026.

This fixed the Income Tax bands at:

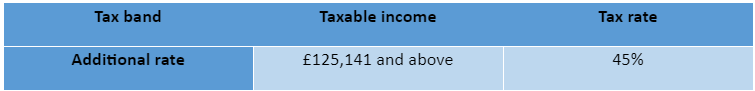

In his 2022 autumn statement in November, though, Jeremy Hunt opted to reduce the threshold at which additional-rate Income Tax is paid from its current level of £150,000 to £125,140 from April 2023.

Crucially, he also announced that the freeze imposed on the basic- and higher-rate thresholds would be extended until at least 2028.

With inflation remaining high and wages set to grow, the extension means you are likely to see your tax bill rise over the next five years.

FTAdviser reports that average wage growth of 5% for the next four years – with tax thresholds remaining frozen – would see a UK worker earning £50,000 a massive £2,643 worse off for the 2027/28 tax year alone. Additional tax losses over the whole period would amount to £6,434.

A rising tax bill could mean its time to revisit your short-term budgeting and your long-term plans

A sudden rise in the amount of tax you pay could put a strain on your budget. This is especially likely with inflation set to remain high over the next few months.

You might need to revisit your monthly budget. Tracking income and expenditure throughout the month can be a great way to highlight areas where savings can be made. Forgotten subscriptions or unused gym memberships are often a sensible place to start.

If your purse strings are still tight, it might be tempting to look longer term.

When times are hard, long-term investments like your pension or any ISAs you hold might look like sensible places to cut back. Paying your future self is crucial, though, and the effects of reducing or ceasing pension contributions now could be huge.

Not only will you miss out on the potential investment returns and compound growth of a larger pot, but you’ll also be foregoing the tax advantages of your pension and ISA wrappers.

Financial advice can help you to regain focus and give you peace of mind

Financial advice can be a huge help when planning your household budget, ensuring your money is going where it is needed most.

This might mean cutting back on discretionary expenditure and focusing your efforts elsewhere – building an emergency fund, say, or paying off high-interest debt.

Speaking to experts can also help you to refocus on your long-term goals. Remember that the financial plans you have in place are aligned with these goals, so if they haven’t changed, your plan shouldn’t need to either.

A simple check-in should reassure you that you are still on track, or help to mitigate the effects of short-term issues, to get you back on the right road as quickly as possible.

Get in touch

If you’re worried about a rising tax bill and its effects on your household finances or long-term plans, we can help.

Please contact us via email at info@investmentsense.co.uk or call 0115 933 8433 to find out more.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results. The tax implications of pension withdrawals will be based on your individual circumstances.

Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.