Cash savings are convenient, straightforward, and are considered a safe way to put aside money. However, inflation is rising and this can devalue your cash in real terms. This is because, in early 2022, cash savings accounts are currently paying interest rates that are much lower than inflation.

For example, if you saved £10,000 a year ago and earned interest at a rate of just 1%, your savings would be worth £10,100 now.

However, considering that the latest Office for National Statistics (ONS) figures show that inflation in April 2022 had reached 9%, the same £10,000 worth of goods that you could have bought a year ago now costs £10,900.

It may look like you’ve made £100 but when factoring in inflation, your cash savings have lost value in real terms. And, it will only get worse if inflation continues to rise.

An alternative could be to invest your money

Even if interest rates were to rise – they have risen three times in 2022 already – it’s likely that they will still be lower than the rate of inflation. This means that cash savings may not be a good way to protect your money from the effects of inflation.

One alternative is to invest your money instead of keeping it in cash savings.

Over time, the returns generated by investing in the stock market have tended to outpace the returns on cash savings. For example, according to Moneyfacts, as of 18 May 2022 the best interest rate on an easy-access cash savings account was just 1.1%.

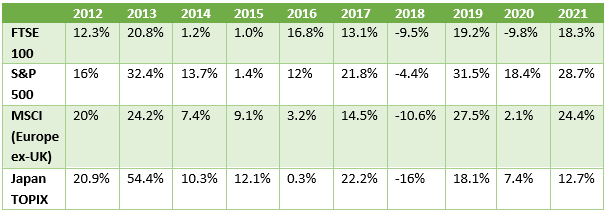

Compare this to the table below, which shows the annual returns of some of the major stock indices over the 10 years leading up to 2021.

Source: J.P. Morgan, FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. All indices are total returns in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data correct as of 31 January 2022.

As you can see, with one or two exceptions, the stock markets have largely produced annual returns that could help inflation-proof your money over the long term. Always remember, past performance is no guarantee of future performance, and you may receive less than your initial investment.

If you’re considering investing your money to try and help it outpace inflation, speak with a financial adviser to discuss the options that may be suitable for you.

The importance of an emergency fund

Some investments are illiquid, which means you can’t cash them out immediately when you need the money. This is why it’s important to have an emergency fund that you can access quickly if you need to.

It can also be helpful when you need access to funds quickly without having to cash out your investments. This can prevent you from selling at a loss or taking on tax consequences.

Your emergency fund should be in a cash savings account so that you can withdraw the money when you need it without incurring any penalties. Most experts suggest keeping three to six months’ expenses in an easy access savings account.

Once you have established your emergency fund, you should then consider whether investing the rest of your cash savings might then give you the potential for growth that could help you to meet your future financial goals.

Get in touch

If you’d like to find out more about saving and investing, please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.