You’ve been planning your retirement for years. World travel, new hobbies, passing your wealth onto the next generation – you’ll no doubt have your priorities worked out, but have you factored in the cost of later life care?

You’ve been planning your retirement for years. World travel, new hobbies, passing your wealth onto the next generation – you’ll no doubt have your priorities worked out, but have you factored in the cost of later life care?

It’s a subject we’re likely not keen to dwell on but the increasing cost of social care means that finding space in our retirement planning for later life is essential.

Here’s our guide to factoring the cost of later life care into your retirement planning.

The rising cost of social care

We’re living longer. The Office for National Statistics reports that life expectancy for a UK male has risen by more than three years since 2000 (and by just over two years for women). This gives us the chance to enjoy a longer retirement whilst increasing the amount of money we’ll need and upping the likelihood that we’ll need to pay for our care in later life.

The government confirmed in 2017 that the care home sector had ‘around 410,000 residents’ and that the average cost for someone in self-funded care during 2016 was ‘£846 per week (nearly £44,000 per year).’

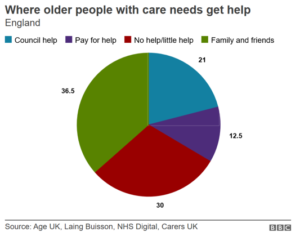

This Age UK graph shows how older people with care needs in England fund their care.

The numbers in care have been projected to ‘rise by 190,000 by 2035’ according to a report in The Independent.

Reasons to plan for later life

Factoring the cost of your later life care into your retirement planning is essential. Here are three reasons why:

1. You’ll know how far your pension will stretch

When planning for retirement, you need to know the amount of retirement income, along with income from other sources, you’re likely to receive. You also need to think about your outgoings. This might include helping your children with university fees, or onto the property ladder.

Adding the cost of later life care into your retirement plan early will give you the best indication of how far your retirement income will stretch and the standard of living you can expect based on the size of your fund.

If you start planning early enough, you can begin to make up any shortfall long before you retire.

2. You can consider the type of care you want

Thinking about the cost of later life care now gives you the chance to look closely at the type of care you’ll want or need.

The main types of later life care are:

- Independent living – Remaining in your own home but making adaptations to your house to ensure it remains suitable for your changing needs

- Home care – Paying for the cost of your care whilst remaining in your own home

- New living arrangement – A move to assisted living or sheltered accommodation allowing you to stay independent whilst having care on hand should you need it

- Moving to a care home – Residential care may be necessary if you are no longer able to live independently

Although it’s not possible to predict the care we might need in later life, it pays to know the options and their associated costs early on.

3. Peace of mind

Having a plan in place gives you the peace of mind that whatever later life throws at you, you are financially prepared. It will give the same peace of mind to your family too.

What will happen to your money if care isn’t needed?

Whilst it’s great to have money set aside for the cost of care, you also need to know what will happen to it if the care is not needed. Having a pot of money set aside for later life care that you don’t need could push the value of your estate above the Inheritance Tax (IHT) threshold – £325,000 for 2019/20.

£5.3 billion was collected in IHT in 2019, but there are ways to mitigate the risk of leaving a large IHT bill behind.

Thorough estate planning means asking yourself these questions:

-

Do you have a will?

Half of UK adults didn’t in 2017 but by leaving your wealth to a spouse or civil partner in your will you will secure a 100% IHT exemption. Having a will in place means you can pass on the money put aside for later life care to your spouse tax-free.

-

Are you making the most of available allowances and gifts?

As you get older the potential cost of care decreases – the money will need to last for a shorter length of time. This will leave you with an excess in your later life care fund. Rather than leaving this money where it is, consider making the most of IHT gifting rules each year to decrease your future IHT liability. The ‘Annual Exemption’ allows you to gift up to £3,000 a year tax-free, including money or possessions.

-

Have you placed your assets in trust?

Placing money for future care in a trust gives you control over how the fund will be passed on. Transferring assets into a trust takes them out of your estate for IHT purposes, though it’s important to take into account the possible tax implications for your intended recipients.

Seek advice

Retirement planning can be complex. You have numerous potential income streams and knowing the cost of your future outgoings isn’t easy either.

We can help you put a retirement plan in place that takes all these factors into account so that you can retire confidently in the knowledge that you are financially secure and that the unexpected has been taken care of.

If you’d like to discuss how the cost of later life care fits into your retirement plan, please get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.