As investors, we like to think that we are rational, have limitless self-control, and are uninfluenced by our own biases. Behavioural finance though would tell us differently.

As investors, we like to think that we are rational, have limitless self-control, and are uninfluenced by our own biases. Behavioural finance though would tell us differently.

You likely have many subconscious investor biases and they could be having a detrimental impact on your ability to make objective decisions.

Understanding these biases – or working with professional advisers that understand them – helps you to take a step back and see your decisions through another person’s eyes. It could also help improve your investment returns.

What do we mean by investor bias?

We need to overcome our own instinctive behavioural biases if we are to invest successfully. But to overcome them, we first need to recognise them.

Different investor biases will affect different types of investors.

You might be a cautious investor, worried about making wrong decisions, and therefore prone to getting too caught up in the short-term. If you’re a risk-taker, on the other hand, you might suffer from overconfidence and this could expose you to unnecessarily high risk.

Some investors have a kind of herd mentality. This could see you follow the investments being made by others without being sure how those investments fit into your own long-term financial plan.

Biases can be cognitive or emotional, and both can have a detrimental impact on your investment returns.

Seven common types of investor bias

Here are some of the main types of investor bias that might be hampering your investments:

1. Confirmation bias

The newspaper you read will most likely be the one whose politics most closely matches your own. So too with investments.

This is confirmation bias and it is a type of cognitive bias. Cognitive Biases most often involves decision-making based on established concepts and assumptions. Like rules of thumb, these ideas are generalised and may not be accurate 100% of the time.

Your natural human tendency is to look for, and to notice, only the information which supports the ideas you already hold. This can prevent you from seeing the bigger picture.

If you believe a certain asset class, sector or company is going to perform well, you might ignore evidence to the contrary, subconsciously seeking out the information that validates your preconception and failing to gain an alternative viewpoint.

2. Loss aversion bias

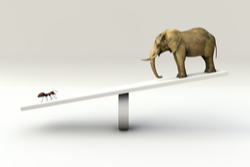

Loss aversion is an emotional bias and is the tendency to place higher importance on avoiding losses, than on achieving gains.

When you make a gain, it is easy to tell yourself it was inevitable. You’ll move on quickly, looking for the next opportunity. When you make a loss though, you may take this personally. Avoiding a loss can end up becoming your sole subconscious aim.

This can lead to poor decision-making and irrational investment choices.

For example, you might refuse to sell investments that are making a loss. By not selling, you avoid having to confront the loss and can hold on to the hope that they will gain in the future, validating your original decision.

3. Overconfidence bias

Overconfidence is a human trait. In terms of investor bias, it can be both an emotional bias and a cognitive one.

This is because it can combine clouded reasoning with the emotional elements of hope and playing a hunch. You might feel that you have insider knowledge or abilities that other investors don’t have, and that puts you at an advantage.

Overconfidence bias can be linked to self-attribution bias. This is a tendency to attribute any successful outcomes to your own actions, while blaming negative outcomes on external factors, outside of your control.

4. Hindsight bias

Hindsight bias is the tendency to believe that past events were knowable and predictable whereas future events are not. You might even convince yourself that you knew an event was going to happen, long before it did.

This can be dangerous. It prevents objective analysis of your past good decisions while absolving you of responsibility for any bad choices you make in the future.

Looking at previous decisions that brought positive results and analysing what made them successful might help you to make similar good decisions in the future. Not learning from past mistakes or errors of judgment leaves you likely to repeat them.

5. Familiarity bias

A sign of familiarity bias could be a preference for recognisable or well-known investments.

You might continue with a familiar investment even though it is performing poorly while at the same time not investing in an unfamiliar area that is performing well. This limits your investment opportunities and your potential returns, ruling out new or upcoming investments.

It could also lead to a non-diversified portfolio with little spreading of investment risk.

6. Trend-chasing bias

At Investment Sense, you’ll often hear us say that past performance is no guarantee of future success, but investors with trend-chasing bias may subconsciously ignore this.

If you have a trend-chasing bias you are likely to chase favourable past returns, even if the present reality is different.

7. Regret aversion bias

To worry about your investments is natural, especially when you have important decisions to make. Regret aversion bias might mean you fail to make any investment decision at all, out of concern that you’ll make the wrong one.

By not making a decision, you avoid the regret associated with making a bad one.

This anxiety can lower your risk tolerance, leading to conservatism and sometimes to a herd mentality – making investment choices based on what other investors are doing.

You might feel a ‘safety in numbers’ from this approach but each investment should be approached objectively. Just because others are making a certain investment choice doesn’t mean it is right for you.

Seek advice

At Investment Sense, we have many years of experience in investment and the markets. We can ensure that your long-term investment portfolio is diversified and in line with your risk profile.

By understanding the different investment biases that exist, we can help you to avoid some of the common pitfalls and keep your investment on track.

Get in touch

If you’d like to discuss any aspect of your investments, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note:

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.