When you read the news first thing in the morning, what sections do you immediately head to?

It’s likely that you focus more on events in the UK, as locally-based news is likely more relatable to you.

However, by subconsciously avoiding news stories regarding other parts of the world, you’re essentially missing out on information that could enrich your life and expand your base of knowledge.

The same thing can be said about investing. Indeed, if you only invest in companies or funds from the UK, you could ultimately be hampering the overall performance of your portfolio. This is called “home bias”.

Continue reading to discover exactly why you may be more inclined to invest in domestic companies, and how you could benefit from greater potential growth by broadening your horizons and looking elsewhere for opportunities.

Home bias is when you focus on investing in companies from your country of origin

“Home bias” simply refers to the tendency to only invest in domestic equities, while ignoring the potential benefits of diversifying in foreign markets.

This could be more common than you think, as Barclays reveals that UK investors allocate approximately 25% of their investments to the home market, despite the fact that UK equities only form 4% of the global index.

You could be falling victim to home bias for several reasons, namely:

- Higher transaction costs in foreign markets

- You can’t access foreign shares or funds using your normal investing account

- Unfamiliarity with markets abroad or foreign companies.

As is the case with many cognitive biases, you may not even realise that you’re experiencing it. Read on to discover why geographical favouritism is so common.

Familiarity and perceived risk could be the reason home bias is so common

To realise why it’s common that you submit to home bias when you’re investing, consider Tesco and Walmart, two similar retailers in the UK and the US.

If you’re living in the UK, you likely shop at Tesco from time to time. You may know their company values, what they offer, and you could even see news articles about them occasionally while you’re scrolling through your favourite media outlet.

Conversely, there’s a chance you don’t know much about Walmart. If you mainly access British news, the supermarket likely isn’t in the news unless a major event occurs.

So, if you decide to invest in a retailer, there’s a good chance you’d choose Tesco over Walmart, partly due to your familiarity with the company.

The same logic can be applied to other companies, as investing in domestic markets could give you a sense of comfort because your holdings will likely be in well-known names.

You may even attach more risk to investing abroad, simply because you don’t understand current events and market trends overseas as much. Or, you may believe that investing in other currencies carries more risk, as many investors trade locally to avoid the need to hedge against currency exposure.

However, if you submit to home bias and allow it to affect your investment decisions, this could limit your access to other, potentially more advantageous, investment opportunities.

Instead, it may be wise to broaden your outlook when you’re considering investing in foreign companies – read on to discover why this is the case.

Global diversification could help you spread risk and benefit from more significant growth

Perhaps one of the key issues with submitting to home bias is that it could inadvertently expose you to greater risk, especially if there’s a significant market downturn in your home market.

In contrast, if you spread your investments across the globe rather than tying most of your wealth in UK-based markets, you could benefit from more growth potential.

This is because markets around the world don’t always necessarily perform the same as each other over the same period of time, offering the chance for varying returns.

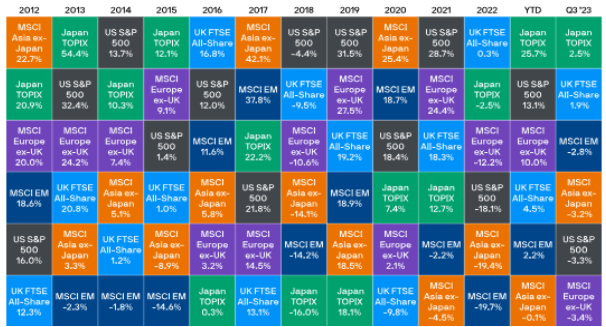

To highlight this fact, the graphic below shows the returns from a number of stock market indices around the world between 2012 and 2023.

Source: JP Morgan

As you can see, there isn’t a consistently best-performing region each year, and returns tend to fluctuate, even over the same period.

Had you only invested in the UK market in 2020, your portfolio could have fallen in value by 9.8%, as shown by the performance of the FTSE All-Share.

However, if you’d diversified globally in 2020 and invested in Asian markets, or in the US, you would have benefited from double-digit returns that may have offset your losses in the UK.

By spreading risk across global markets, rather than just investing at home, you’re essentially giving yourself the chance to generate returns elsewhere.

Working with a financial planner could help you avoid home bias

One way that you can reduce your home bias is to work with a financial planner. We can help you build a diversified portfolio that is aligned with your risk profile and long-term aims.

To find out more about how we could help you, please email us at info@investmentsense.co.uk or call 0115 933 8433.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.