Receiving professional financial advice can improve outcomes, helping you to achieve your dreams. That’s the reason we do what we do: we understand the financial benefits of being well-informed and looking after your money.

Receiving professional financial advice can improve outcomes, helping you to achieve your dreams. That’s the reason we do what we do: we understand the financial benefits of being well-informed and looking after your money.

But the benefits aren’t only financial ones. Money means more than a large house and luxury holidays, although these are great too. It also means emotional wellbeing, not just for you, but for your family.

A recent Royal London survey looked to quantify the benefits of advice using a range of factors, looking at both financial and emotional wellbeing.

Keep reading to find out what receiving regular financial advice could mean for you.

The benefits of holistic advice

You might find you only speak to your adviser now and again. Maybe you want advice on a specific product you’ve heard about, or you have a specific need – you’re nearing retirement, or your child wants your help getting onto the property ladder?

This is known as transactional advice and it is the reason most of those surveyed (38%) visited their adviser. Only 23% rely on their adviser to provide a regular review of their whole financial situation. And yet it is this holistic approach that leads to the highest levels of customer satisfaction.

Speaking to your adviser on a transactional basis is unlikely to lead to the same openness, or closeness of relationship, that you might have if you saw your adviser more regularly.

What’s more, although an adviser can help answer your transactional queries and put a plan in place, your finances aren’t just your pension, or your life insurance, or your investments. They are comprised of all of these things, working in harmony within a much bigger picture.

That’s where holistic advice comes in. By looking at the products you have in the context of your wider financial situation and your aspirations for the future, we can build a complete picture and form a closer relationship, allowing us to offer tailored solutions.

Building a relationship takes time and it’s only through regular contact and catchups that we can check-in on changing goals or life events, adapting your plan accordingly.

In the Royal London survey, wealth management advice received 75% overall satisfaction compared to 83% for those whose advice was broader, taking in the whole of their financial situation. Tellingly, the figure for overall satisfaction increased when holistic advice was received regularly, rising to 90%.

If you haven’t checked in with us for a while, maybe now is the time. A full financial review following an unprecedented year could be just what you need to ensure you’re on track, in terms of both your financial and emotional wellbeing.

Advice can bring emotional wellbeing

Regardless of your household income level or your retirement plans, we all have financial worries now and again. Although you may approach an adviser for financial help, feeling better about your money can lead to you feeling better about yourself.

The benefits of financial advice on your emotional wellbeing shouldn’t be overlooked. They fall into three main areas:

- More confidence in your financial plans

- Feeling more in control of your finances

- Increased peace of mind

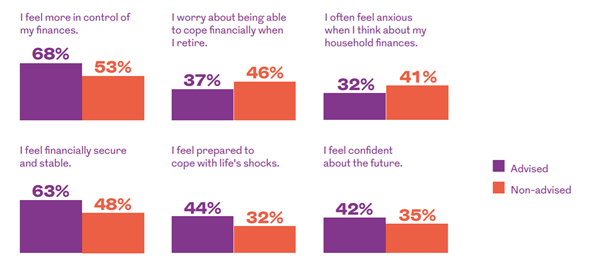

These three areas encompass many aspects of your day-to-day life, from worries about household income and financial shocks to retirement plans and confidence in the future.

Source: Royal London

As you can see, those receiving financial advice experience real emotional benefits compared to those not getting the advice they need.

The benefits of protection

Knowing that you have financial protection in place and that you and your family will be looked after should the unexpected happen, can help improve your emotional wellbeing. It puts you firmly in control and can also give you confidence too.

Life insurance can provide enormous peace of mind, especially for homeowners. Knowing that your mortgage will be paid off in the event of your death, means knowing that your family will still have a roof over their heads should the worst happen.

And yet the latest figures from comparison site Finder confirm that only 50% of households with mortgages have life insurance.

Those who seek financial advice are twice as likely to have protection insurance in place and the emotional wellbeing of those who are protected is improved.

If you’d like to read more about the types of protection products you might consider, why not read What financial protection do you have against the unexpected? or speak to us

Get in touch

The connection between our finances and our emotional wellbeing shouldn’t be overlooked.

Regular meetings with an adviser, taking a holistic approach to your finances, is the best way to see positive outcomes. Building a long-term relationship based on your individual circumstances and aspirations for the future can help put you in control of your finances, giving you confidence and peace of mind for the future.

If you’d like to discuss any aspect of your long-term financial plan or would like to book in for a meeting, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

Life Assurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.