Investing can be complex and emotional too. By understanding the basics, such as why you’re investing, your attitude to risk and reward, and how long you’re intending to invest, you can give yourself the best chance of seeing positive outcomes.

Investing can be complex and emotional too. By understanding the basics, such as why you’re investing, your attitude to risk and reward, and how long you’re intending to invest, you can give yourself the best chance of seeing positive outcomes.

Understanding the type of investor you are

Emotions can play a large part in the investment decisions you make.

The short-term volatility back in March might have made you tempted to sell when the markets were falling. You could have ended up selling at the bottom out of panic and buying back in late, having already missed the start of the bounce back.

Think about the reason you are investing. It can give you a long-term goal, keep you focused, and help you understand your attitude to risk.

If you’ve recently started a family, for example, you might want to save some money for Further Education fees for when your child reaches age 18.

Investing in the stock market over that term could deliver healthy returns but with your child’s education as the goal, your attitude to risk might below.

If you’re investing for your own retirement, and it is still decades away, you might be willing to take more investment risk, at least to begin with.

As already mentioned, the stock market can be volatile. Investing over the long term helps your money to recover from short-term market shocks. If you’re saving for retirement you won’t want to take unnecessary risks with your accumulated fund in the months before you retire.

It’s natural to want to avoid losses at any time. It’s called ‘loss aversion.’ It’s the reason why, as human beings, we see ‘not losing £100’ as better than ‘gaining £100’. Applied to investing, though, this can severely affect your outcomes.

A more holistic understanding of your attitude to risk and the purpose of your investments can help to avoid emotional knee-jerk reactions and unnecessary risk.

Risk versus return

Different types of investment carry different levels of risk.

Funds held in a savings account, for example, won’t go down, whereas shares in a company carry more risk and you could lose your invested amount. Share prices can rise and fall daily but the added risk means potential for greater reward.

Remember to consider the hidden risk of your ‘low-risk’ savings account. With interest rates low, the impact of inflation could mean your savings are losing value in real terms. A small amount of risk might be necessary to keep up with the cost of living.

Understand your risk profile and you can match it to the products that are right for you. We can help you with this.

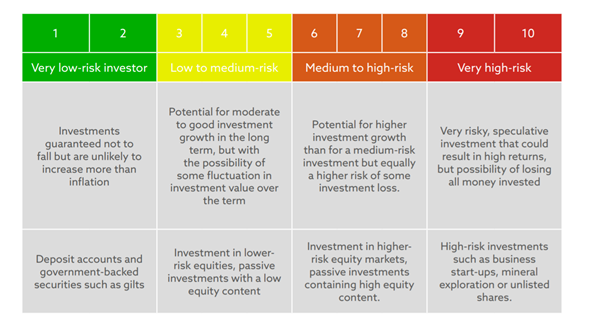

The table gives an overview of investment risk per product, where one is the lowest risk and ten the highest.

You can see that government-issued bonds are a low-risk investment that is unlikely to generate a large return. Investing in high-risk company shares – such as for business start-ups – however, have the potential for greater returns, as well as the possibility that you won’t get back what you put in. You could lose all your invested money.

Invest for as long as possible

Investment is a long-term concern, so invest for as long as you can, but at least five years. And remember that it’s not timing the market, it’s time in the market that counts.

J.P. Morgan Asset Management highlighted the impact of pulling out of the market. Over the 20 years from 1 January 1999 to 31 December 2018, they found that missing the top ten best days in the stock market could reduce the value of your portfolio by half.

That’s the result of ten days missed, over a period of two decades.

Remember that short-term volatility is the price you pay for longer-term growth. Historic stock market performance confirms that the markets have a generally upward trend. Remaining patient, not panicking, and avoiding emotional reactions gives the best chance of positive outcomes.

Get in touch

If you’d like to discuss what a rise in pension age will mean for your long-term financial plans, get in touch. Please email info@investmentsense.co.uk or call 0115 933 8433.

Please note

The value of your investment (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.