Flexi-Access Drawdown

Flexi Access Drawdown, or FAD for short, is the new term for drawdown pension, previously known as Capped or Flexible Drawdown.

Flexi Access Drawdown allows you, from the age of 55, to leave your pension pot invested and withdraw as much or as little as you want over any period. Up to 25% of the fund can be taken as a tax-free lump sum. Any additional amounts withdrawn, whether lump sums or income, will be added to any existing income and then taxed.

It is also possible with some pension plans to draw the tax-free element as a series of regular or one-off payments, until all the tax-free allowance has been used, then any future income or lump sums are taxable.

Money not withdrawn continues to be invested. This means you continue to potentially benefit from any fund growth in a tax-efficient environment, but conversely you remain exposed to investment risk and potential losses.

After you have started Flexi Access Drawdown you will be able to make further pension contributions. However, if you take any income or withdraw a lump sum, in addition to the tax-free lump sum, you will have a reduced annual allowance of £4,000 for future contributions to defined contribution plans, for example Personal Pensions or Self-Invested Personal Pensions. This is known as the Money Purchase Annual Allowance (MPAA).

If you already have a Capped Drawdown arrangement, the rules are different and we would suggest you speak to one of our retirement specialists if you are intending to make a contribution.

Where you remain a member of a Final Salary or Defined Benefit occupational pension scheme, you will also benefit from the standard annual allowance for these contributions.

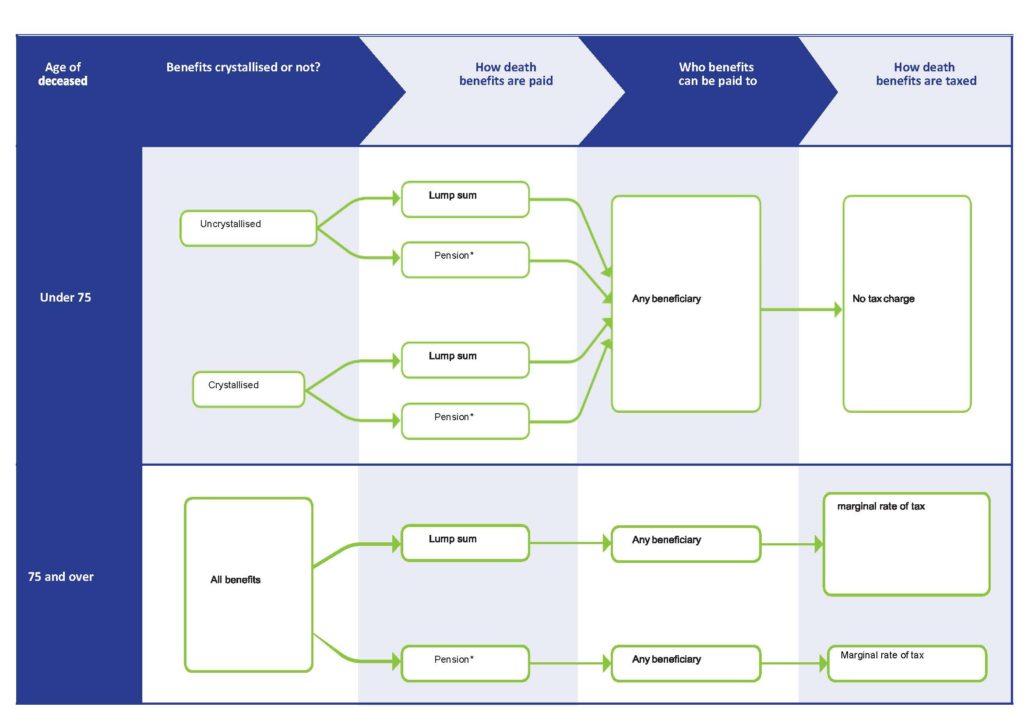

If you die with funds remaining in a Flexi Access Drawdown arrangement, your beneficiaries will have several options:

- Continue to take income and / or lump sums

- Buy an annuity

- Take the remaining fund as a lump sum

The amount of tax your beneficiaries will pay depends on the date of your death and is explained in the following flow chart:

*Pension means regular income payments or ad hoc lump sums

Advantages of Flexi Access Drawdown

- You have immediate access to some or all the tax-free cash available

- Flexi Access Drawdown avoids the need to purchase a Lifetime Annuity

- You have complete flexibility to withdraw income and / or lump sums to suit your requirements, allowing you to influence the level of tax you pay on that income

- Your pension fund, less the plan charges and income taken from it, remains fully invested, allowing the potential for capital growth in a tax efficient environment

- On death, your beneficiaries will have a wide range of options to choose from to suit their own needs

- Difficult decisions, such as whether to purchase an Annuity can be deferred until your personal circumstances or objectives become clearer

- You may become eligible for an Enhanced Annuity in the future

Disadvantages of Flexi Access Drawdown

- There is no guarantee that your income will be as high as that provided by an Annuity

- Future investment returns are unknown and the value of funds will fluctuate over time

- A combination of poor investment returns and high-income withdrawals can reduce the value of your remaining fund. Withdrawing too much income in the early years may have an adverse effect on preserving the pension purchasing power or preserving the capital value of your fund

- The value of the remaining fund may not be enough to maintain income at the same level as an Annuity bought at the outset

- Flexi Access Drawdown can be a complex arrangement requiring annual reviews, decisions to be made on desired income levels and an appropriate investment strategy. It is likely to require ongoing advice with ongoing advice costs